Understanding Depreciation and How to Calculate it for Your Home Office Deductions

Post #31: Depreciation of your home can be a difficult concept that most business owners and freelancers overlook as part of the Home Office Deduction.

In this Substack, I will walk you through the process of starting, operating, maintaining, and — if needed — selling or closing your own small business.

Today, I’m going to introduce the concept of Depreciation and guide you through deducting this often overlooked home office deduction. As a self-employed freelancer or business owner, you may be eligible to deduct Depreciation to reduce your tax bill.

Specifically, I will cover:

A quick refresher on home office deductions and eligibility

A brief description of Depreciation

Why Depreciation is deductible as a home office expense

Why renters are not eligible to deduct Depreciation

A step-by-step walk through of how to calculate Depreciation

A sample calculation using real world data to show you how Depreciation works

Why you should recalculate Depreciation every year

What to do if you are selling your home (after taking Depreciation deductions)

A few links to related topics that are not covered in this post for easy reference

👉 Subscribe to this Substack if you want to learn how to setup, operate, maintain, scale, etc… a small business. The Journey began with Post #1.

Also, be sure to check out these FREE resources:

Bootstrap Your Business Workflow - a step-by-step guide with the links to all of the top daily posts that walk you through the process from scratch

BYB Book Recommendations - a collection of the best business books to help you on your entrepreneurial journey

BYB News Alerts! - urgent news and updates for self-employed and business owners - delivered to your inbox - so that you can be more prepared

About Home Office Deductions

A quick refresher…

As a small business owner operating from home, understanding the nuances of tax deductions can significantly impact your bottom line.

To find out whether you are eligible to deduct home office expenses, check out my last post on this topic:

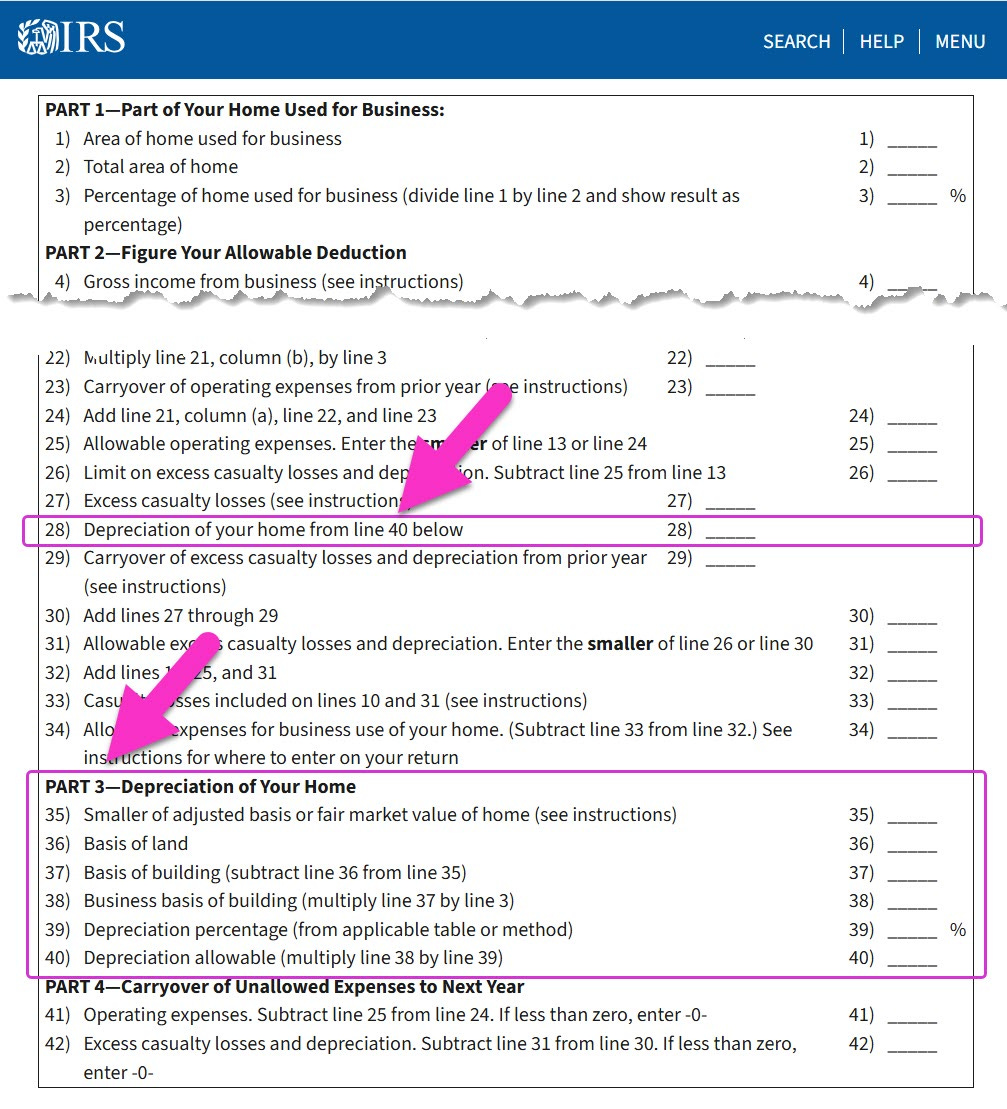

IRS Worksheet for Schedule F

The IRS website has a boatload of useful resources to help you.

Be sure to check out the “Worksheet To Figure the Deduction for Business Use of Your Home” (click here: IRS Worksheet for Schedule F).

On this worksheet, Depreciation of your home for business usage can be entered under “PART 3 - Depreciation of Your Home” and “Depreciation of your home from line 40 below” (these two sections are cross-referenced in the IRS worksheet).

💡 Tip: Don’t be afraid of the IRS! If you are following the rules and doing the right thing, you can deduct these expenses as part of your business operations. Read more…

What is Depreciation?

Depreciation is the process of allocating the cost of a tangible asset over its useful life.

In other words, Depreciation is a way to spread out the cost of an asset over the time it's used.

For property owners, this means deducting a portion of the property's cost each year to account for wear and tear, aging, or obsolescence.

In the context of home office deductions, Depreciation allows self-employed individuals and small business owners to deduct a portion of their home's value used for business purposes, thereby reducing taxable income.

For example, if you buy a piece of equipment for your business, instead of recording the full cost as an expense in the year you buy it, you allocate portions of that cost over its useful life. This approach matches the expense with the revenue the asset helps generate each year.

In this post, I am focusing only on Depreciation of residential real estate, rather than equipment for your business.

💡 Tip: There are exceptions to deducting Depreciation across the “useful life” of the property.

Section 179 of the U.S. tax code allows businesses to immediately deduct the full purchase price of qualifying equipment and software, up to a limit of $1,220,000 for the 2024 tax year, rather than depreciating these assets over time.

Subscribe to learn more about this topic in an upcoming post!

Why is Depreciation Deductible?

When you use part of your home exclusively and regularly for business, the Internal Revenue Service (IRS) will allow you to deduct a portion of your home's expenses, including Depreciation.

Wear and tear on your home, as a part of normal business use, can eat into your costs of doing business.

💡 Tip: Be sure to check out my previous post on how to deduct home repairs and maintenance, which is another way to capture your costs of doing business from your home.

Sorry, Rented Space is Not Depreciable

Unfortunately, if you rent your home and someone else owns the property, you can’t deduct any Depreciation from your income taxes.

There are other benefits to renting your home, with regard to home office deductions, which I cover in more detail here:

Calculating Depreciation on Your Home (for Home Owners)

To calculate the Depreciation deduction for your home office, follow these steps:

(1) Determine the Business Percentage of Your Home

You will need to know how much of your home is being used for home-based work.

Measure the square footage of your home office, or “workspace”.

Divide the workspace by the total square footage of your home.

Workspace Square Footage / Total Home Square Footage = Business Percentage

This percentage represents the portion of your home used for business.

💡 Tip: This calculation may be slightly different depending upon whether you have roommates, rent an apartment, or own your home. Read more…

(2) Identify Variables for the Depreciable Basis

Before running the final calculation, identify important variables that are used in this calculation.

Specifically, you need to know:

Original Purchase Price (OPP): The amount you paid to buy your home.

Home Improvements (HI): The cost of significant enhancements that add value, prolong its life, or adapt it to new uses (e.g., adding a room, installing a new roof).

Casualty Losses (CL): Deduct any losses from events like fires or storms that were not fully restored (i.e.: if your home has incurred damage that has not been repaired, it may be worth less).

Land Value (LV): the fair market value (FMV) of the land on which your home is situated. Land itself is not depreciable, so it needs to be subtracted.

(3) Calculate the Depreciable Basis

With the variables from above identified, now you can do the math to determine your Depreciable Basis.

Take the Original Purchase Price.

Add total Home Improvements.

Subtract Casualty Losses.

Subtract Land Value.

OPP + HI - CL - LV = Depreciable Basis

(4) Determine the Depreciation Deduction Total

With the Depreciable Basis value calculated, you can determine how much Total Depreciation you can deduct for home office expenses.

Take the Depreciable Basis (from Step 3)

Multiply Depreciable Basis by the percentage of your home that is occupied by your workspace (from Step 1)

Depreciable Basis x Business Percentage of Your Home = Depreciation Deduction

(5) Calculate the Depreciation Deduction for This Year

Unfortunately, you can’t deduct the whole Depreciation Deduction amount (from Step 4) all at once.

The IRS views Depreciation as a long-term event and requires residential property to be depreciated over 27.5 years (for most Depreciation expenses).

💡 Tip: if you want to review more information from the IRS website on where this value of 27.5 years came from, go here: https://www.irs.gov/publications/p946.

So, let’s take the final step in this calculation:

Divide the Depreciable Basis by 27.5 to find the annual Depreciation amount.

Depreciable Basis / 27.5 = Deductible Amount for your Home Office Deductions This year

Okay, Let’s Make This Real

Let’s do this calculation again, but swap out the variables with information that is more tangible.

💡 Tip: To make more sense of this calculation, you can swap out the numbers in this example with your own, too!

Meet the Smiths…

Bob and Sally Smith bought a 3,200 square foot single family home in Springfield, with a closing date of January 2 (of last year year). They paid $419,200 for a lovely 3 bedroom, 4 bathroom with a 2-car garage in a nice neighborhood. Sally walks their 2 daughters to school in the morning.

Bob works downtown as an employee (W2) at a corporate office, and Sally runs her own business (LLC) and works exclusively from home as a freelance writer.

Shortly after closing on their home, Bob hired a construction crew to remodel the previously unfinished basement so that Sally could have a home office and he could have a dedicated and heated space for his fly-fishing hobby (he likes to make his own flies). The remodel cost them $42,000 in total, of which $8,000 was spent specifically on Sally’s nice and big home office which is 160 square feet.

In late December of last year, Bob found a leak in the garage that is estimated to cost $10,000 to repair. It’s not a serious problem, so they decided to wait the upcoming spring when the weather is nice and they have enough money saved to do the work without taking out a loan.

From the County Assessor website, the Smiths know that the land value of their property was assessed for $83,840 (20% of the property’s total value).

The Smiths Do the Math…

Since Bob works as an employee downtown, he cannot deduct any home office expenses from his income.

However, Sally is eligible for home office deductions because she works exclusively from her home office and has a a registered business that is an LLC.

(Step 1) They calculate the Business Percentage of their Home:

Workspace Square Footage / Total Home Square Footage = Business Percentage

160 sq ft. x 3,200 sq. ft. = 0.05 = 5%

(Step 2) They Identify Variables for the Depreciable Basis:

Bob and Sally pull the paperwork that they got from the Title company when they Closed on their home and pulled some data for use in these calculations.

Original Purchase Price (OPP): $440,160

The home price was $419,200 before closing fees.

Closing costs were an additional $20,960 including loan origination fees, appraisal fees, title insurance, home inspection, property taxes, recording fees, real estate agency fees, and attorney fees.

Home Improvements (HI): $42,000 in total to remodel the basement

Casualty Losses (CL): $10,000 (to repair the garage roof leak)

Land Value LV): $83,840

(Step 3) They Calculate the Depreciable Basis:

Since Depreciation is only valid for Sally’s business income taxes, her home office is where the calculations can be applied.

OPP + HI - CL - LV = Depreciable Basis

$440,160 + $42,000 - $10,000 - $83,840 = $388,320

This is the TOTAL value of the Depreciable Basis.

(Step 4) They Determine the Depreciation Deduction Total

With the total Depreciable Basis calculated, now they can figure out the portion of their home that is eligible for the total deduction across 27.5 years.

Depreciable Basis x Business Percentage of Your Home = Depreciation Deduction

$388,320 x 5% = $19,416

(Step 5) They Calculate the Depreciation Deduction for This Year

Since they can’t deduct the whole Depreciation Deduction in one year, this value has to be spread across 27.5 years (to keep the IRS happy and not send you a nastygram that you are going to be audited).

Depreciable Basis / 27.5 = Deductible Amount for your Home Office Deductions This year

$19,416 / 27.5 = $706.04

With all of this math calculated, Sally will get to deduct $19,416 in total, or $706.04 every year for 27.5 years from her business income!

That’s a significant deduction over the time that Sally is working from her home!

Recalculate Depreciation Every Year

The Depreciation Deduction is not a one-time math problem.

📌 Each and every year, you can update some of these variables to include Depreciation-related changes made to your home that impact your costs of doing business.

These are the variables that may change over time:

Home Improvements - you may decide to continue with further remodeling projects as your lifestyle changes, such as when the kids move out, when your parents move in, and if you need more space for your home office.

Casualty Losses - if new damage occurs to your home and repairs are not made, this value could increase.

Note: If repairs are completed, this value decreases and you may be able to shift these costs to your home repair and maintenance deductions.

Land Value - over time, the Fair Market Value of your land is likely to increase due to inflation, and other economic reasons. Stay on top of this assessment by periodically checking the County Assessor website.

Business Percentage of Your Home - if your business grows and you need more space in your home, be sure to keep up with this calculation as it could have a significant impact on how much you can deduct.

💡 Tip: for more information, and to ensure that you don’t make a mistake in this calculation, be sure to review the IRS Publication 946, How to Depreciate Property.

Your unique circumstances may affect your values and calculations.

What Happens When I Sell My Home?

If you sell your home, be aware that Depreciation deductions taken may affect the capital gains exclusion.

The IRS may require you to pay taxes on the Depreciation recapture, which could impact your overall tax liability.

💡 Tip: I will cover this topic in more detail in an upcoming post.

Subscribe to get notified when new posts are published!

Additional Considerations

Check out these topics, which I covered in earlier posts, to make sure that you have all of your bases covered:

How can I determine whether I am eligible for Home Office Deductions?

Is there more information on how to calculate the Business Percentage of Use?

What is the difference between Depreciation expenses and Home Repair and Maintenance expenses?

What other Home Office Expenses can I deduct as part of my home-based business?

What if I choose to use the Simplified Method for calculating Home Office Deductions?

Due Diligence

Do your due diligence with these calculations and to ensure that you are not miscalculating your deductions.

I am an entrepreneur - not a tax professional or a CPA - so please keep in mind that your unique circumstances may require other methods, variables, and/or calculations.

Bob and Sally Smith are fictitious characters and their story is just my attempt to demonstrate to you how Depreciation deductions could work with sample data.

If needed, it is best to consult an accountant or tax advisor to help you when you are confused or uncertain.

Next Steps

In the next post, I am going to discuss a far less complex kind of home office expenses that you can deduct from your business income: Office Supplies and Equipment (desks, chairs, computers, printers, etc.).

Continue the Journey with Post #32 —>

This is my day to day, great take!