Save Money on Your Taxes By Deducting Homeowners or Renters Insurance

Post #29: Freelancers and small business owners can keep tax bills lower with home office deductions, including the premiums spent on residential insurance.

In this Substack, I will walk you through the process of starting, operating, maintaining, and — if needed — selling or closing your own small business.

Today, I am going to continue on the path of helping you save money on your annual taxes by deducting the cost of your homeowners or renters insurance premiums.

This simple and forgotten deduction can save you a ton of money over the long-term, if you are eligible to deduct home office expenses from your income.

Money-wise freelancers and business owners include this deduction as a normal part of doing business, and you can too.

👉 Subscribe to this Substack if you want to learn how to setup, operate, maintain, scale, etc… a small business. The Journey began with Post #1.

Also, be sure to check out these FREE resources:

Bootstrap Your Business Workflow - a step-by-step guide with the links to all of the top daily posts that walk you through the process from scratch

BYB Book Recommendations - a collection of the best business books to help you on your entrepreneurial journey

About Home Office Deductions

A quick refresher…

As a small business owner operating from home, understanding the nuances of tax deductions can significantly impact your bottom line.

To find out whether you are eligible to deduct home office expenses, check out my last post on this topic:

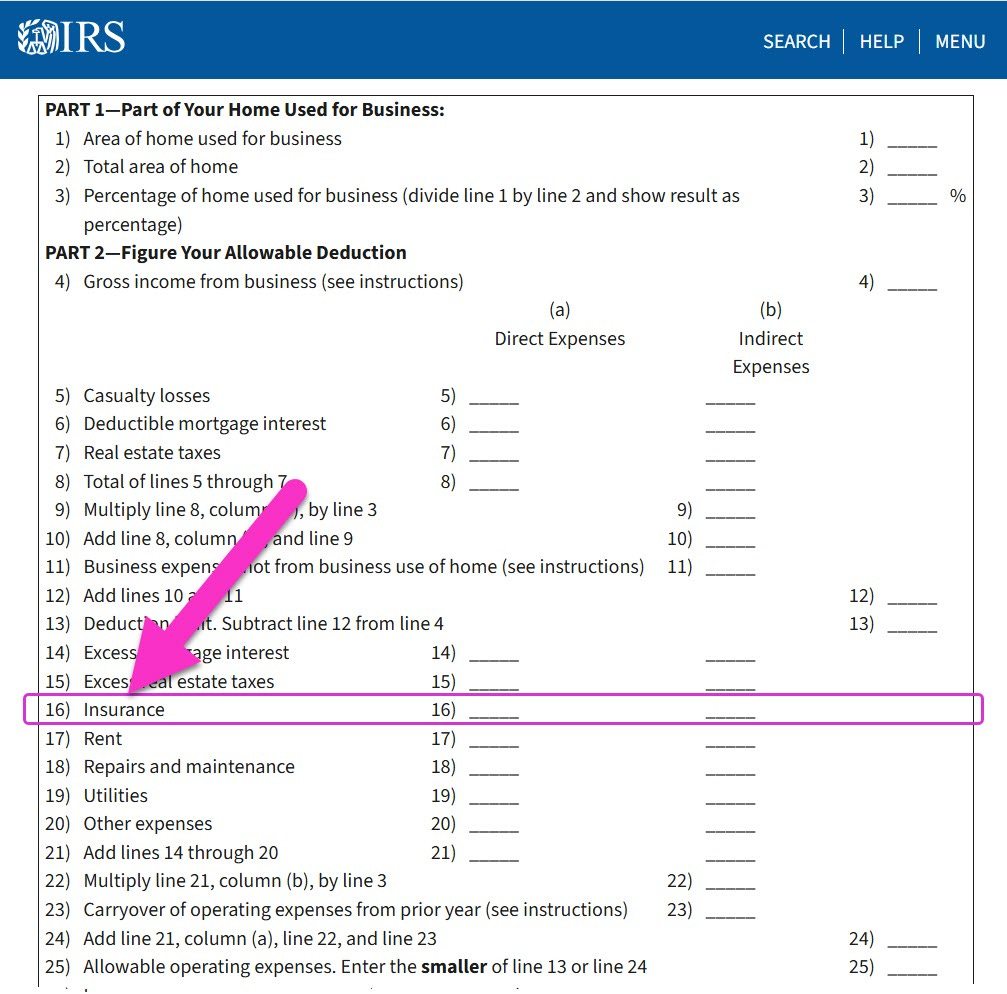

IRS Worksheet for Schedule F

The IRS website has a boatload of useful resources to help you.

Be sure to check out the “Worksheet To Figure the Deduction for Business Use of Your Home” (click here: IRS Worksheet for Schedule F).

On this worksheet, Homeowners and Renters Insurance premiums are considered “Insurance”.

💡 Tip: Don’t be afraid of the IRS! If you are following the rules and doing the right thing, you can deduct these expenses as part of your business operations. Read more…

Why Your Homeowners or Renters Insurance Is Eligible for a Home Office Deduction

The U.S. Internal Revenue Service (IRS) allows self-employed individuals - such as freelancers, independent contractors, and solopreneurs - to deduct expenses related to the business use of their home, provided certain conditions are met.

This includes a portion of your homeowners or renters insurance premiums.

To qualify, the area designated as your home office must be used exclusively and regularly for business purposes. This means the space should not serve dual purposes, such as a guest bedroom, dining room, or that comfy couch where you like to snuggle with the cat.

💡 Tip: Learn more about eligibility to deduct home office expenses. And Subscribe to receive notifications as I publish more on this topic!

By meeting these criteria, a percentage of your insurance premiums becomes deductible as a business expense.

Calculating the Deductible Portion of Your Insurance Premiums

To determine the deductible amount, you'll need to calculate the percentage of your home's square footage that is dedicated to your home office.

Here's how:

(1) Measure Your Home Office Space

Determine the square footage of the area used exclusively for your business.

For example, this could be the half of your bedroom where your desk and computer are located, or a spare bedroom that has been converted into a home office.

Just be sure that the space is exclusively used for business purposes.

(2) Measure Your Entire Home

Calculate the total square footage of your residence.

If you don’t want to physically measure each room and add them all up (which could be tedious and inaccurate), you may be able to find this information online:

Your local County Assessor has every property mapped and catalogued with tons of data about the features and attributes of your home (i.e.: square footage, land acreage, HOA fees, materials used to build, roof style, etc.).

Various real estate websites also have a lot of information about homes, condos, and townhouses in your area (e.g.: Zillow, RedFin, Trulia, etc.).

Or, if you are renting an apartment, your property manager should have this information readily available.

(3) Calculate the Percentage

To find the percentage of your home that your workspace occupies, use this calulation.

Home office square footage / Total home square footage = Percentage

For example, if your home office is 200 square feet and your home is 2,000 square feet, the calculation would be 200 ÷ 2,000 = 0.10, or 10%.

(4) Determine the Dollar Value You Can Deduct

Take the percentage you calculated above and multiple this by your total insurance bill for the whole year (for your annual home office tax deduction).

This percentage represents the portion of your homeowners or renters insurance premium that you can deduct.

For example, if your annual premium is $1,500, you could deduct 10% of that amount, equating to $150.

💡 Tip: if you are sharing your home with roommates, your total square footage calculation may be different. Read more…

When Insurance is Not Deductible

In some scenarios, you can’t deduct your homeowners or renters insurance.

Non-Exclusive Use: If the space serves both business and personal functions, it doesn't qualify. For instance, using a dining room table for work and family meals disqualifies the area.

Employee Status: If you're an employee working from home and receive a W-2 from your employer, you generally cannot claim home office deductions.

Living with Parents: If you live with your parents and do not pay any money towards the homeowners insurance or renters insurance that they pay, you cannot deduct this expense.

Co-working Space: If you are renting a co-working space and run your business from this location, insurance is typically included in the fees paid. Review your contract or ask the space proprietor for more information if you are unsure.

Record-Keeping Tips

In order to qualify for the home office deduction and to deduct your insurance from your business income, good record-keeping is a must.

Be sure to have the following documents saved in your record-keeping system just in case you have to prove your expenses as part of an IRS audit.

Lease agreement (if renting): Make sure that your name is on the lease.

Property title or mortgage (if a home owner): Make sure that your name is on the property title or the mortgage payment bill

Insurance premium bill or statements: Keep the monthly bills, semi-annual statements, or whatever paperwork you receive from your insurance company.

Percentage Calculations (of your workspace): Document the space your business occupies with a simple floor plan and the calculations you used to determine the total residential space, total workspace, and the percentage used for the home office deduction.

No one likes the IRS (or finding out that they are being audited). But, when you are prepared, an audit can be just another task to complete in your busy schedule as a business owner.

Next Steps

In the next post, I am going to cover the more complex aspect of deducting Home Repairs and Maintenance as part of your home office expenses.

So many business owners miss out on this deduction, which could be a HUGE component of your home office deductions. Don’t be one of them!

👉 Continue the Journey with Post #30 —>