Maximizing Your Home Office Deductions: How to Save Money on Taxes

Post #25: There are many advantages to being a business owner - chief among them is deducting expenses as part of your financial strategy.

In this Substack, I will walk you through the process of starting, operating, maintaining, and — if needed — selling or closing your own small business.

Today, I am going to share one of the greatest financial advantages of running your own business - being able to reduce your taxable income by deducting home office expenses.

Specifically:

What are home office expenses

Who qualifies to deduct home office expenses (and who doesn’t)

How much of a difference these deductions can make in your annual income tax bill

How to calculate your home office expenses

Before we dive in too deep, keep in mind that not every business owner qualifies for these deductions, and there are specific rules to follow to ensure compliance with tax regulations (which I will cover in this post).

👉 Subscribe to this Substack if you want to learn how to setup, operate, maintain, scale, etc… a small business. The Journey began with Post #1.

Also, be sure to check out these FREE resources:

Bootstrap Your Business Workflow - a step-by-step guide with the links to all of the top daily posts that walk you through the process from scratch

BYB Book Recommendations - a collection of the best business books to help you on your entrepreneurial journey, with direct links to Amazon.com

What Are Home Office Expenses?

Home office expenses refer to the costs associated with maintaining and operating a dedicated workspace in your home for business purposes.

These expenses can include a portion of your rent or mortgage, utilities, internet, office supplies, and more (see the list, below).

The IRS allows eligible business owners and freelancers to deduct these expenses from their gross income, effectively lowering their taxable income and reducing their overall tax liability.

Who Qualifies for Home Office Deductions?

Don’t be intimidated by the threat of an IRS audit when you are perfectly right to be deducting legitimate business expenses from your income to reduce your tax bill.

To qualify for home office deductions, a business owner or self-employed individual must meet these IRS criteria:

Exclusive Use

The workspace must be used exclusively for business activities. If the area is also used for personal purposes, it does not qualify.

For example, if you converted that unused guest bedroom into an office for your business, this bedroom could qualify as long as it is no longer used as a guest bedroom.

Principal Place of Business

The home office must be the primary location where business activities occur, or it must be used regularly for client meetings or administrative work if the business operates elsewhere.

For example, if you work as a freelance writer or an independent contract software developer and you work remotely from home, your home office qualifies as a principal place of business. Occasional trips to your client’s office or to attend a work team offsite retreat will not negatively impact this qualification (in most cases) because these are not typical workplaces for you.

Self-Employed Individuals

Freelancers, independent contractors, and small business owners who operate from home typically qualify (there are exceptions).

For example, if you are in the construction business and spend the majority of your time at building sites, but run your business from home - processing invoices, paying bills, and otherwise managing your business - you most likely still qualify.

Employees Who Are Also Self-Employed)

As of recent tax laws, W-2 employees cannot deduct home office expenses unless they are self-employed in addition to their W-2 employment.

For example, if you have a full-time job as a W-2 employee working as an office assistant during normal business hours, but you make money with a home-based side hustle on evenings and weekends, you can probably deduct home office expenses from the income you earn in your side hustles.

💡 Tip: To learn more and to see if you meet the IRS’s qualifications, you should review the IRS’s website on this topic.

Start here → https://www.irs.gov/newsroom/small-business-owners-should-see-if-they-qualify-for-the-home-office-deduction

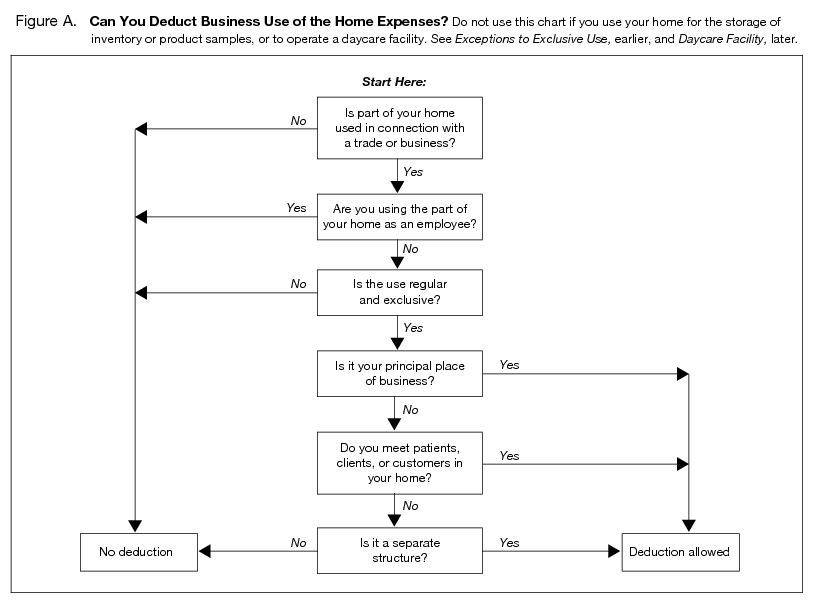

Can you deduct business-use-of-the-home expenses? (an IRS model)

This easy-to-use chart provided by the IRS (on the IRS.gov website, see link in caption) will help you determine whether your workspace qualifies.

Who Does NOT Qualify for Home Office Deductions?

While home office deductions can be a great tax-saving strategy, some individuals do not qualify:

W-2 Employees without self-employment income: Employees working remotely for an employer cannot claim home office deductions under current tax law.

Businesses without a dedicated office space: If you work from a shared space like a dining table or couch, you do not meet the ‘exclusive use’ requirement.

Part-time or occasional use areas: If the space is not regularly used for business, it does not qualify.

Businesses primarily conducted elsewhere: If you operate your business from a storefront, rented office, or co-working space and only use your home for occasional work, you may not qualify.

Every situation is unique and there are always exceptions to these guidelines. When in doubt, check the IRS website (link above), or talk to a professional who can help you with this determination.

Why Deduct Home Office Expenses?

How Much Can You Really Save?

Home office deductions can significantly reduce your taxable income, which basically means you would pay less in overall taxes. The exact savings depend on your expenses, income, and tax bracket.

Here’s an example:

If your total annual home expenses (including mortgage or rent, utilities, insurance, etc.) add up to $24,000 annually (that’s $2,000 per month), and your home office takes up 10% of your home’s square footage, you may be able to deduct $2,400 from your business’s gross earnings. If you are in the 24% tax bracket, that deduction could save you around $576 in taxes for the year.

That $576 is a huge chunk of an entire month of your total home expenses!

These savings add up quickly!

💡 Tip: If you don’t deduct these expenses from your income, you are simply sending too much money to the IRS in taxes!

Home Office Expenses You Can Deduct

While this is not a comprehensive list, it will help you begin the process of capturing these expenses as part of your bookkeeping and record-keeping systems.

[Note: if there are links, click to view a more detailed article on that topic, and subscribe to be notified when the remaining are published!]

Mortgage Interest or Rent (percentage of your home used for business)

Utilities (electricity, water, heating, and cooling)

Internet and Phone Bills (portion used for business)

Homeowners or Renters Insurance (percentage related to home office space)

Repairs and Maintenance (specific to home office, or a portion of whole-house repairs)

Depreciation (if you own your home)

Business Furniture and Equipment (desks, chairs, computers, printers, file cabinets, etc.)

Property Taxes (proportional to home office space)

Taking advantage of these deductions can help you keep more of your hard-earned money while ensuring compliance with IRS rules.

💡 Tip: I will be diving into each of these categories with much more detail and examples in the upcoming posts.

Subscribe to be notified when a new post is published!

By maintaining your home office as a dedicated workspace, saving your receipts, and keeping good records, you can make a significant impact on your business's financial health and pay less in taxes overall.

If you're unsure about your eligibility or how to calculate your deductions, consulting a tax professional can help you maximize your savings while staying within legal guidelines.

Calculating Home Office Expenses

There are two primary methods for calculating your home office deduction:

Per the IRS website,

Simplified Method: The IRS allows a flat deduction of $5 per square foot of your home office, up to 300 square feet. This is an easy option but may result in a smaller deduction. (See IRS.gov source here)

Regular Method: This method involves calculating actual expenses based on the percentage of your home used for business. You must track all eligible expenses and apply the appropriate percentage to determine your total deduction. (See IRS.gov source here)

Note that the regular method often provides a larger deduction but you will need to be good with record-keeping to ensure that you can provide appropriate evidence in the event of an audit.

Whichever method you choose, maintaining accurate records and receipts is essential to support your claim in case of an audit.

👉 As a business owner, it is always best to save all of your receipts! 👈

Taking advantage of these deductions can help you keep more of your hard-earned money while ensuring compliance with IRS rules.

Next Steps

In the next post, I am going to dive deeper into how you can calculate your home office deduction for Mortgage Interest or Rent.

👉 Continue the Journey with Post #26 —>