Invoicing Your Clients and Customers: A Guide for the Self-Employed

Post #41: Eliminate the awkwardness around asking for money by sending invoices and get paid for your work.

In this Substack, I will walk you through the process of starting, operating, maintaining, and — if needed — selling or closing your own small business.

Today, I am going to write about Invoicing. 😱

Whether you hate asking for money or you feel awkward sending an invoice to your clients and customers, this is how you get paid.

📌 You will have to get over these feelings …or you will go broke.

In this guide, I will cover:

What is an invoice

What you should include in an invoice

What an invoice looks like

Get an invoice template that you can customize and reuse

How often invoices should be sent (i.e.: invoicing frequency)

How to ask a client for payment (…without being awkward)

The importance of having a contract before you start working

Additional tips for easier invoicing

👉 Subscribe to this Substack if you want to learn how to setup, operate, maintain, scale, etc… a small business. The Journey began with Post #1.

Also, be sure to check out these FREE resources:

Bootstrap Your Business Workflow - a step-by-step guide with the links to all of the top daily posts that walk you through the process from scratch

BYB Book Recommendations - a collection of the best business books to help you on your entrepreneurial journey

BYB News Alerts! - urgent news and updates for self-employed and business owners - delivered to your inbox - so that you can be more prepared

BYB Documents - a repository of guidance for important business documents with instructions and guides to use them in your self-employment journey

What is an Invoice?

If you provide professional services as a freelancer, solopreneur, or small business owner, you need to invoice your clients accurately, consistently, and quickly.

An Invoice is a document that formally requests payment from a client for services rendered.

It serves as both a record of the transaction and a tool for bookkeeping and tax purposes.

Most clients and customers need an invoice for their record-keeping system, just as much as you need it for yours.

What You Should Include in an Invoice

If you haven’t created an invoice before, here is an overview of what you and your clients will need to include in this document:

Your Business Information

Near the top of the invoice, include your business name, address, email, and phone number.

Be sure to include the address for snail-mail payments (e.g.: paper checks) if this is different from your primary business address.

If your business has a logo, include this for branding and to make it easier for your client to identify who sent the invoice (it could speed up the payment processing time).

Client Information

Also near the top of the invoice, provide the name and contact details of the client you are invoicing so that there is no confusion in the event of an error.

Some companies have a separate accounting department that processes payments. Include the client’s accounting department information on the invoice, if available, so that the invoice can get quickly routed to the right internal office for faster payment.

Invoice Number

Often in the top margin of your document, the unique identifier for the invoice should be prominently displayed.

This will improve tracking of payments and make it easier for everyone to reference a specific invoice in communications.

💡 Tip: Plan your invoice numbering structure.

For example, if you start with Invoice #001, your client will know that this is your first real invoice (i.e.: this is not recommended).

Instead, use systematic invoice numbering, as follows:

If the client name is Best Client Ever, Inc. and you are sending them the 5th invoice in 2025, then you might number your invoice:

2025.005.BCE or BCE.2025.005

This way, you can quickly see:

how many invoices you sent to Best Client Ever, Inc. in 2025,

not give away how many other invoices you have sent out in 2025 to other clients, and

all of your invoices will appear in an organized list in your record-keeping system.

Invoice Date

The invoice date is just the calendar date when the invoice was issued (i.e.: when you sent it to the client).

This date will make it easier to determine payment due dates and simplify accounting.

Invoice Period

This is a date range during which the work was completed or the products were sold.

Most companies like to track activity within a calendar year as part of their Key Performance Indicators (KPIs) or business budgeting (among other reasons) so using date ranges will help you get on the same page with your clients.

Payment Due Date

The deadline by which payment is expected from the client is typically determined through an agreement (or contract) that was created before the work began.

💡 Tip: I will explain more about contracts and agreements in an upcoming post.

Subscribe or Follow Me to get notified when new posts are published!

In the accounting world, this is often referred to as NET payment terms or just Payment Terms.

Payment Terms

Specify how long the client has to pay the invoice following the date that you sent the invoice (the Invoice Date) and what will happen if they don’t pay on time.

The most common terms are Net 15 and Net 30, which are usually specified upfront in the agreement or contract between your company and your client.

The Payment Due Date and Payment Terms are usually shown near each other on an invoice for clarity.

Description of Services Rendered (& Products Sold)

To reduce confusion and payment delays, provide a summary of the services you performed, including hours worked, project details, and deliverables.

When an itemization is helpful, break down the Amount Due (below) into smaller chunks so that your client can see what they are buying. This will help to reduce disputes about transparency.

Also, just as you have been capturing your business expenses for deduction, your clients will need to do the same. Be sure to give them enough information to capture a breakdown of your fees into the right accounting categories.

Amount Due

This is the total amount owed, including applicable taxes, reimbursable expenses, fees, and other costs that you expect to be paid.

When in doubt, spell it out.

Clients like to know where their money is going, too.

Payment Instructions

In addition to a snail-mail address for physical payment methods, provide information to help your clients make their payment on time.

If you prefer to set up a EFT (bank transfer), that can be done with a separate form (i.e.: it is best to not ask for bank information in an invoice to protect your and your client’s banking security)

Otherwise, provide instructions for making payments via PayPal, credit card, check by mail, etc.

Late Fees

If late fees will be applied for receiving the payment late, be sure to make this clear as earlier as possible to avoid disputes.

Late fees are typically a flat percentage of the total invoice, but not large enough to feel like a penalty or punishment.

It is best to provide great customer service and be realistic with late fees to avoid causing your clients to be upset.

Wherever possible, consider waiving late fees when payment confusions arise.

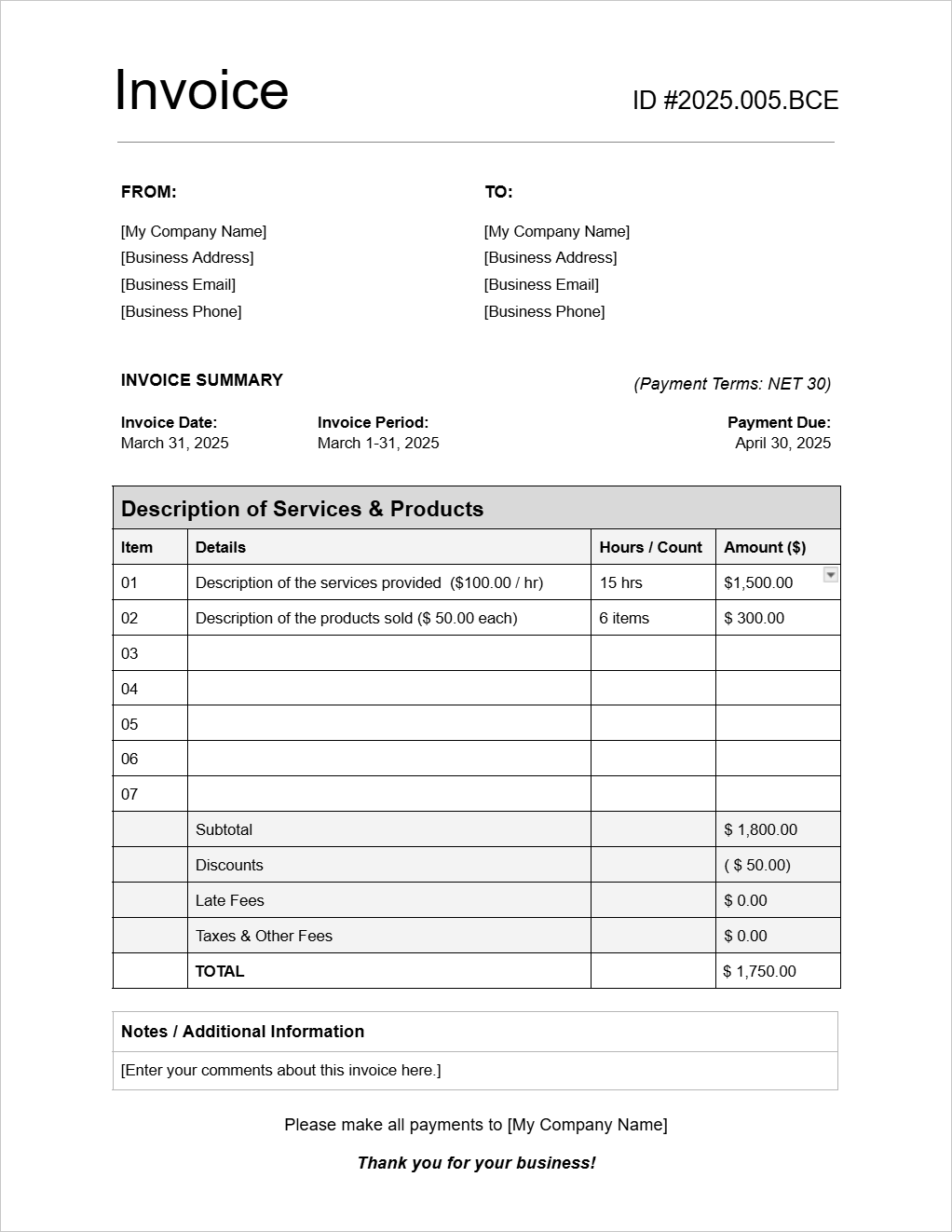

What an Invoice Looks Like

Another very simple document, an invoice can be used over and over again.

Here is a very simple Invoice template:

Get the Template

If you want to save your precious time, you can buy the template here:

Invoicing Frequency

Depending on your business type, you might choose one of the following invoicing schedules:

Upon Completion of Work: Best for project-based or one-time services.

Biweekly or Monthly: Suitable for ongoing work or retainer agreements.

Milestone-Based: Better for larger projects where payments are split into stages or phases following completion of each.

Regardless of which schedule you choose, be consistent so that you and your clients can get on a regular invoicing and payment schedule.

How to Ask Clients for Payment

One of the biggest advantages of using a structured invoicing system is that it eliminates the awkwardness of asking for money directly.

Instead of chasing clients for payments, let your invoices do the talking.

A well-crafted invoice establishes a professional expectation that payment is due, and sets the stage for an effective professional relationship.

Don’t be scared!

A few suggestions…

Send the Invoice Promptly

As soon as work is completed, send the invoice without delay.

I prefer to send invoices the morning after the Invoice Period ends.

For example, for a February 1-28 Invoice period, I send the invoice on March 1).

Use Professional Language

Avoid overly casual wording.

Instead of "Hey, can you pay this?"…

Try this:

Attention: Accounting Department of Best Company Ever, Inc.

Please find the attached invoice (#2025.005.BCE) for services rendered during Period December 1-31, 2024. Payment is due by January 31, 2025."

Thank you for your business!

Send (Polite) Reminders

If a client hasn't paid by the due date, send a polite reminder to let them know that you have not yet been paid.

You may want to wait a few days (5-10 at most) just in case your client encountered some accounting delays or your invoice got routed to the wrong department.

Try this:

Attention: Accounting Department of Best Company Ever, Inc.

Our records indicate that payment has not yet been received for Invoice #2025.005.BCE, which was due on January 31, 2025 for work completed during Period December 1-31, 2024.

The invoice is attached for reference.

Please let us know when we can expect payment or an update.

Per the terms of the agreement, late fee of 5% will be applied to payments made more than 30 days past the due date.

Thank you - we appreciate your business!

The Importance of Having a Contract

Even if you claim that you’re “not good at this stuff”, it will be difficult to get paid if you never had any formal agreements with your client.

A contract:

Protects you and your business from exposure (to a variety of risks).

Ensures that you and your client agree to the scope, timeline, and payment terms of the project before work begins.

Creates a legal document that can be used to prove that you are owed payment, if things get really messy and you can’t get paid.

Makes it a lot easier to send invoices without the awkwardness of asking for money.

💡 Tip: I will cover contracts and agreements in a future post!

Subscribe or Follow Me to get notifications when new posts are released!

Additional Tips for Smooth Invoicing

A few parting recommendations:

Use Invoicing Software

Tools like QuickBooks, FreshBooks, or Wave streamline invoicing and payment tracking.

Offer Multiple Payment Options

The easier you make it for clients to pay, the faster you’ll get paid.

Track Outstanding Invoices

Maintain a system to follow up on unpaid invoices promptly.

Keep Records for Tax Purposes

Store all invoices for at least three years in case of an audit.

💡 Tip: Discover how long to keep your business records in my earlier post:

Next Steps

My next post is the first in a series on Real World Case Studies where you can learn the story of a real entrepreneur and how they manage their business.

Continue the Journey…