Financial Management Tips for Solopreneurs and Entrepreneurs

Post #20: Keep your business and personal finances separate.

In this Substack, I will walk you through the process of starting, operating, maintaining, and — if needed — selling or closing your own small business.

Today, I’m going to cover (at a high level) the importance of financial management for small business owners, including:

Differentiating your business from a hobby (per the IRS);

Keeping personal and business finances separate, and;

Other recommendations for managing your small business finances.

Whether you’re just starting out or are a few months into your entrepreneurial journey, financial management is an essential component to running your own business.

👉 Subscribe to this Substack if you want to learn how to setup, operate, maintain, scale, etc… a small business. The Journey began with Post #1.

To review:

You decided on the service or product to offer and came up with potential business names [Posts 1 & 2].

You checked a variety of sources to ensure that your potential business name has not already been claimed [Posts 3–10].

You made sure that your new business name would stand out to potential customers and not cause confusion [Post 11].

You chose the right business structure, registered your business, got a DBA for your brand name, acquired an EIN from the IRS, learned why it’s a good idea to convert your Sole Proprietorship to an LLC, and discovered the benefits of upgrading your LLC to an S-Corp [Posts 12-17].

You set up a record-keeping system, and learned about the importance of good bookkeeping [Posts 18-19].

See my Bootstrap Your Business Workflow for all of these links and more!

Business vs. Hobby (IRS Qualifiers)

While every entrepreneur has a variety of reasons to start a business, a key differentiation of a business — when compared to a hobby or pastime — is earning revenue.

Keeping track of your income and expenses will make it a lot easier to demonstrate that your business truly is a business, in the eyes of the Internal Revenue Service (IRS).

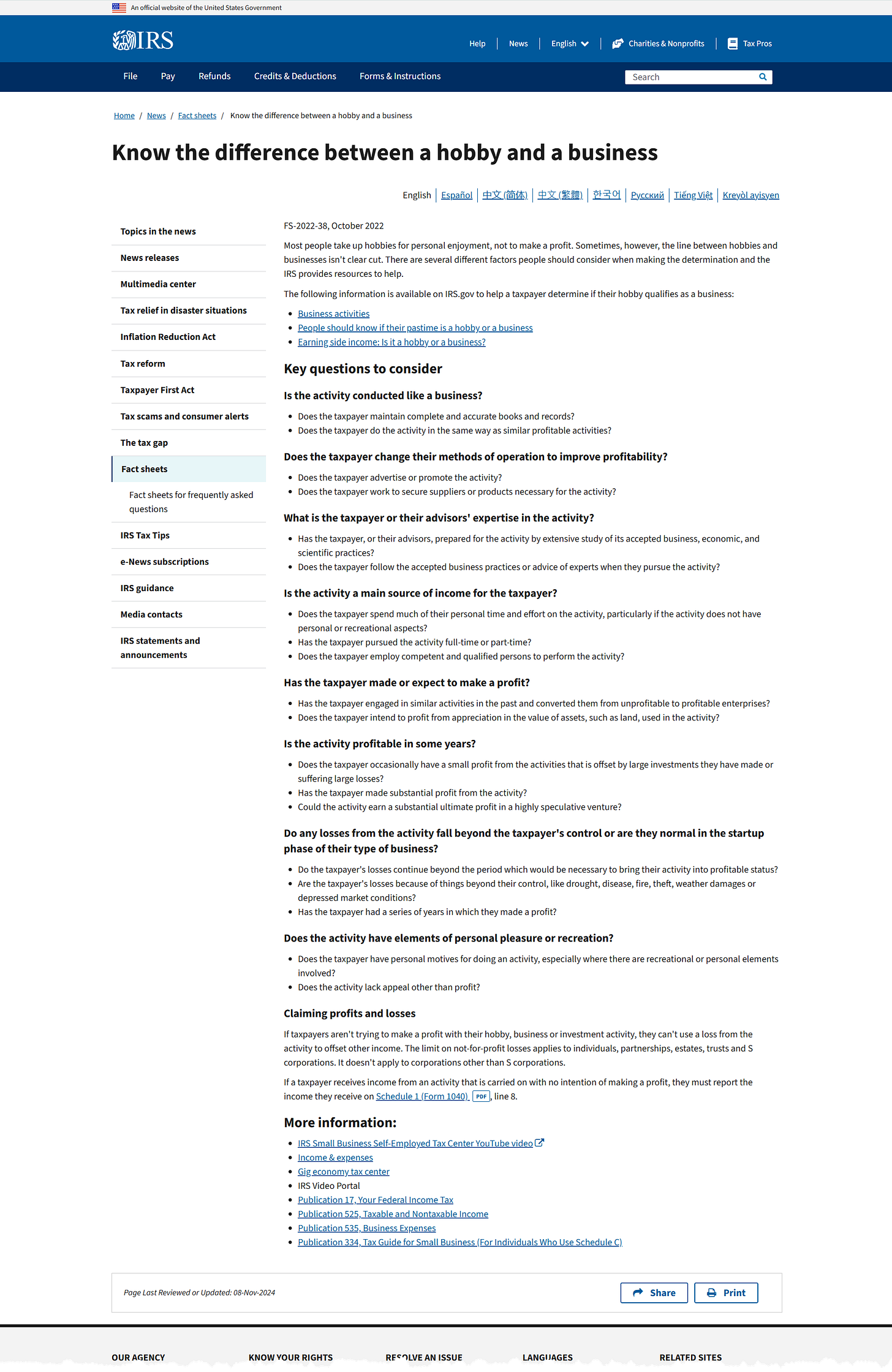

💡 Tip: Check out the comprehensive list of qualifiers that the United States Internal Revenue Service (IRS) has prepared to help you differentiate your business from a “hobby”.

Why You Need to Separate Business from Personal Finances

Aside from ensuring that you don’t get in trouble with the IRS for calling your hobby a business…

There are many reasons for keeping your personal and business accounts separate:

Simplify Tax Preparation

Managing your business finances separately from personal accounts isn’t just a best practice—it’s a game-changer when tax season rolls around.

Here’s why:

Keeping personal and business finances separate makes it easier to track income and expenses when filing taxes.

At the end of each month - when you are capturing all of your expenses to deduct from your income for eventual tax reporting - reviewing business receipts and bills is much simpler without the distraction of personal paperwork.

Consistent record-keeping and bookkeeping systems help you to be prepared in case of an IRS audit (which is rare, but unpleasant!).

Setting aside funds in a business savings account for tax payments helps avoid surprises when tax season arrives.

Legal Protection

If your business is structured as an LLC or Corporation (such as an S-Corp), maintaining a separate bank account helps establish your business as a distinct legal entity.

💡 Tip: Learn more about LLCs and Corporations:

This separation, often referred to as “corporate veil protection,” safeguards your personal assets, such as your home and savings, from being targeted in lawsuits or business debts.

Keeping funds separate reinforces the legal distinction between you and your business.

Professionalism

A business bank account allows you to accept checks and payments in your company’s name, which enhances credibility and trust with clients and customers.

It shows that you’re running a legitimate business rather than treating it as a hobby.

Professionalism also extends to using tools like business credit cards, which can offer additional flexibility and rewards tailored to business needs.

Improve Financial Clarity

By separating your personal and business finances, you can more easily assess your business’s financial health.

This clarity helps you track your cash flow, understand your profit margins, and make informed decisions. It also enables you to create detailed reports to share with potential investors or lenders.

A dedicated savings account can further support clarity by setting aside funds for emergencies or future investments.

💡 Tip: Learn more about Business Bookkeeping:

Build Credit for Your Business

A business bank account is often a prerequisite for establishing business credit.

Building a strong credit profile can help you secure loans or lines of credit with better terms, which can be crucial for scaling your business.

Having a well-documented financial history also makes you more attractive to lenders.

Some banks offer business credit cards as part of their services, which can be a helpful tool for building credit and managing expenses.

💡 Tip: In an upcoming post, I will share guidelines for setting up a business banking account. Subscribe to learn more!

Make it Easier to Sell (or Close) Your Business

Separating your business and personal accounts is especially valuable when it comes time to sell or close your business.

Clear financial records that are exclusively tied to your business makes it easier to provide potential buyers or partners with accurate financial statements, increasing your credibility and the likelihood of a successful sale.

Additionally, it simplifies the process of valuing your business, as buyers can clearly see revenue, expenses, and profit margins without sifting through unrelated personal transactions.

If you’re closing the business, separate accounts streamline the process of settling debts, distributing remaining assets, and filing final taxes, reducing the risk of errors and ensuring compliance with legal and financial obligations.

Recommendations for Managing Business Finances

As a solopreneur or entrepreneur, here are a few recommendations to help you get on the right foot for successful business ownership.

Choose the Right Bank for your Business Accounts

Look for a bank that understands small businesses and makes it easy for you to talk to a banker or financial advisor in person.

If you can’t get to a local branch in person, check for availability to these resources by phone.

Many banks offer accounts with features like low fees, online banking, and integrations with accounting software. Compare your options and consider:

Monthly maintenance fees (if any)

Transaction limits

Online and mobile banking capabilities

Customer service quality

Additional services, such as business credit cards or savings accounts

Gather Documentation to Set Up a Business Accounts

Before heading to the bank, gather the following documents:

Employer Identification Number (EIN): If you don’t have one, you can apply for free on the IRS website. Read more…

Business Formation Documents: These include your Articles of Organization or Incorporation. Read more…

Operating Agreement: If you’re an LLC, some banks require this document. Read more…

Business License: Certain businesses may need to provide proof of licensing. Read more…

Personal Identification: Bring your driver’s license or other government-issued ID.

Some banks may require additional information in order to set up a new account.

💡 Tip: If you are already a customer, your existing relationship with a specific bank may streamline the process of setting up a new business banking account.

Use Business Accounts Exclusively for Business

Once your account is set up, use it exclusively for business-related transactions.

Deposit all business income into the account and pay for all business expenses from it.

If you need to fund your business personally, transfer money from your personal account as an “investment” rather than mixing funds.

💡 Tip: Keep your receipts to make this work less painful than it should be!

Benefits of Business Credit Cards

A business credit card can be an excellent tool for managing cash flow and earning rewards.

Look for cards with features like low interest rates, cashback on business expenses, and travel perks.

Use the card responsibly to build your business credit profile.

💡 Tip: if you accidentally use a personal credit card when making a business purchase, that’s okay! No need to panic…

You can always reimburse yourself as part of your bookkeeping efforts. I will dive into expenses, reimbursements, and month-end reconciliation in an upcoming post.

Subscribe to be notified when this topic is released!

Digital Wallets & Online Payment Tools for Business

Consider opening digital wallets or other money management accounts, such as PayPal, Venmo, or Stripe, for handling client payments.

These platforms are especially useful for online businesses or businesses that need to process credit card payments. Just make sure that you link them to your business bank account to keep transactions consolidated.

Set Aside Cash for a Business Emergency

If possible, maintain a separate business savings account for emergencies or unexpected expenses.

This financial cushion can be a lifesaver during slow months or when there are unexpected costs.

Consider Keeping a Petty Cash Fund

A petty cash fund is a small amount of cash that a business keeps on hand to cover minor expenses, such as office supplies, postage, or employee reimbursements for small purchases.

It helps avoid the hassle of writing checks or using a company credit card for low-value transactions.

Even though petty cash is for small expenses, accurate tracking of each purchase made will ensure transparency and compliance, especially for tax reporting and internal financial management.

Save Money to Make Tax Payments

Use a business savings account to set aside funds for taxes.

Having a dedicated account for this purpose ensures you won’t be caught off guard by quarterly or year-end tax bills.

💡 Tip: if you want to learn more about any of these topics, dm me with your questions or leave a comment and I’ll add it to my queue for future posts!

Opening a business bank account is a foundational step that every entrepreneur should take. It’s not just about keeping things organized — it’s about setting the tone for professionalism and future growth.

Next Steps

In the next issue, I’m going to cover business planning… because flying by the seat of your pants is not a good business plan!

👉 Continue on the Journey with Post #21 —>