📝 Expense Report: Create a Document to Pay Yourself Back for Business Expenses

Post #39: Use this simple document to itemize and reimburse yourself (or your staff) for business expenses paid out-of-pocket.

In this Substack, I will walk you through the process of starting, operating, maintaining, and — if needed — selling or closing your own small business.

Today, I am going to help you with the creation of a super simple Expense Report to use for tracking and reimbursing business expenses to yourself (as an individual), to your staff, or to contractors working for you.

In this post, I will show you:

What is an Expense Report

What an Expense Report looks like

Why you need to document business expenses in an Expense Report

When you DON’T need to use an Expense Report

A link to download a simple customizable Expense Report template

This easy-to-use document is an important part of your record-keeping system and will support the process of creating a “paper trail” to reduce your risks of losing an IRS audit.

Note: if you are capturing your expenses and reimbursements in an accounting software tool, there should be a file type called a “Bill” that you can use for expense reporting. Read on to get clarity for this exception.

👉 Subscribe to this Substack if you want to learn how to setup, operate, maintain, scale, etc… a small business. The Journey began with Post #1.

Also, be sure to check out these resources:

Bootstrap Your Business Workflow - a step-by-step guide with the links to all of the top daily posts that walk you through the process from scratch

BYB Book Recommendations - a collection of the best business books to help you on your entrepreneurial journey

BYB News Alerts! - urgent news and updates for self-employed and business owners - delivered to your inbox - so that you can be more prepared

BYB Documents - a repository of guidance for important business documents with instructions and guides to use them in your self-employment journey

What is an Expense Report?

(a quick refresher)

An Expense Report is basically a document that itemizes purchases and money spent that a business owes to a third party (including yourself, if you purchased these items personally with a personal payment method).

Expense Reports are typically used to capture irregular or one-time expenses, not recurring expenses that are better treated as a “Bill”.

And, while similar to a “Bill”, Expense Reports are most often used by employees, staff, contractors, and owners of a company to support data entry into accounting software.

💡 Tip: For more info, review expense reporting and reimbursements in this article:

Also, be sure to check out this article about Records Retention to know how long you will need to retain records - like an Expense Report - in your files.

What an Expense Report Looks Like

An Expense Report is really a rather simple document.

But, it could be worth its weight in gold if you are getting audited by the IRS because it is an important part of a good record-keeping system and financial management.

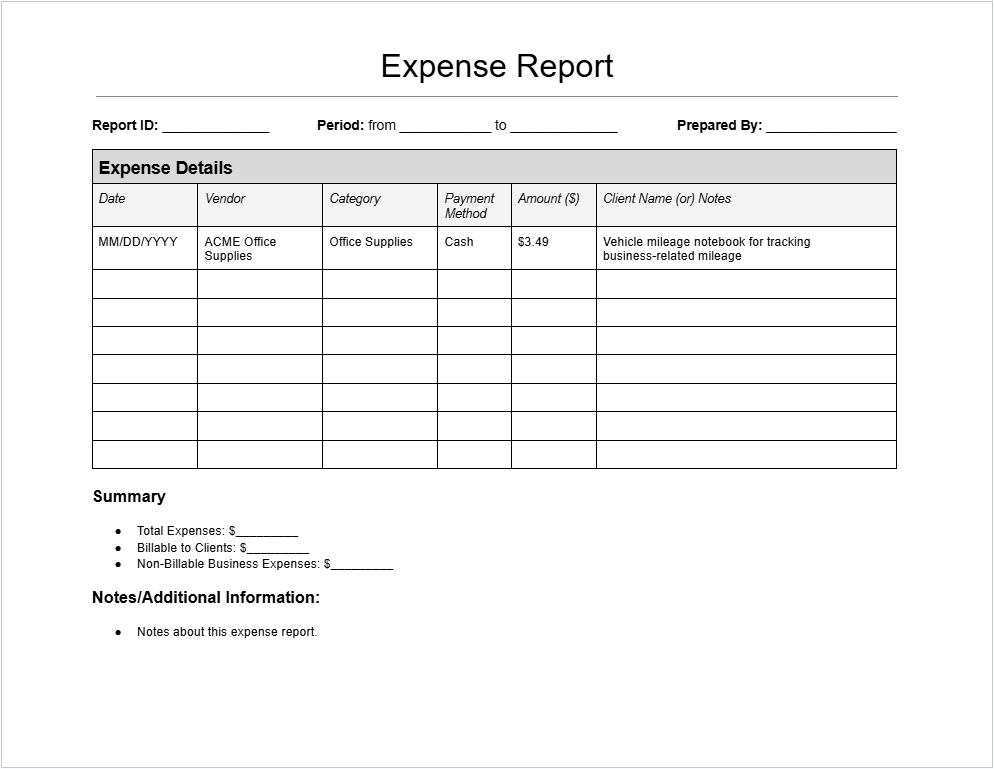

Here is a very simple Expense Report template:

See! There is nothing to it, really.

5 Reasons to Use an Expense Report

Even if you’re a solo business owner, keeping track of your expenses is a necessary part of business administration. Here’s why:

Tax Deductions: A clear expense report helps you capture every deductible business cost.

Client Reimbursement: If you incur costs while working for a client, you need documentation to bill them.

Staff or Contractor Reimbursement: If you have staff on your payroll or contractors doing work for you, they may need to use your expense report to request reimbursement for expenses that they have purchased.

Financial Clarity: Tracking expenses helps you understand where your money is going and manage cash flow.

Audit Protection: In case of an IRS audit, having well-documented expenses can save you from unnecessary penalties.

When You DON'T Need an Expense Report

You may not need to create an Expense Report under these circumstances:

If you are already using accounting software

If you track all of your business expenses directly in an accounting tool (like QuickBooks, FreshBooks, or Zoho Books), separate Expense Reports may be unnecessary.

However, if your staff does not have access to your accounting software, a simple Expense Report template - for their use - will help you with data entry. Ask them to capture their itemized expenses (with their receipts) and submit them all to you or your bookkeeper.

If no personal expense reimbursement is needed

If you did not personally pay for any business expenses that need to be reimbursed in a given period, you can skip creating an Expense Report for that period.

📌 Be careful not to let yourself get too far behind in your record-keeping. If there were no expenses to capture, be sure to document “zero” someplace!

If you used your business’s credit card or bank account

If all business expenses were charged to a company-issued credit card and were already reconciled within your business accounting records, an additional Expense Report may not be required.

This is another reason for why you want to keep your business and personal accounting (and bank accounts) separate - to save time with manual data entry across accounts.

If you have separate bills for specific expenses

If you create a stand-alone bill to get a reimbursement for your home office expenses (such as rent, utilities, or internet usage which you paid for personally), then these expenses would not be added to a new Expense Report to avoid double-counting the expense.

Be sure to only record expenses for reimbursement once.

💡 Tip: I will cover stand-alone bills for reimbursement in an upcoming article.

Subscribe or Follow Me to be notified when a new post is released!

Get the Template

If you want to save your precious time, you can buy the template here:

What You Need to Complete this File

The following data fields are needed to complete this simple template:

A unique Report ID (to make it easier to find a specific expense report)

The Period during which expenses were incurred (usually monthly)

Name of the person who prepared the Expense Report

Expense Details (the itemized list, in a table), including

Date

Vendor

Category

Payment Method

Amount ($)

Client Name (or) Notes

Summary Fields for reference:

Total Expenses

Billable to Clients

Non-Billable Business Expenses

A text field for Notes/Additional Information

Due Diligence

Do your due diligence when you are creating any Expense Report documents as part of your record-keeping system.

I am an entrepreneur - not a tax professional or a CPA - so please keep in mind that your unique circumstances may be different from what I have captured here.

When uncertain or confused, it is best to consult an accountant or tax advisor to help you.

Next Steps

In the next post, I am going to cover how to get organized with your digital file and record-keeping system.

I will include a recommended file storage hierarchy (a folder system) that you can use from Day One to avoid ending up with Chaos.

Continue the Journey with Post #40 —>