Don’t Wait to Establish a Record-keeping System for Your New Business

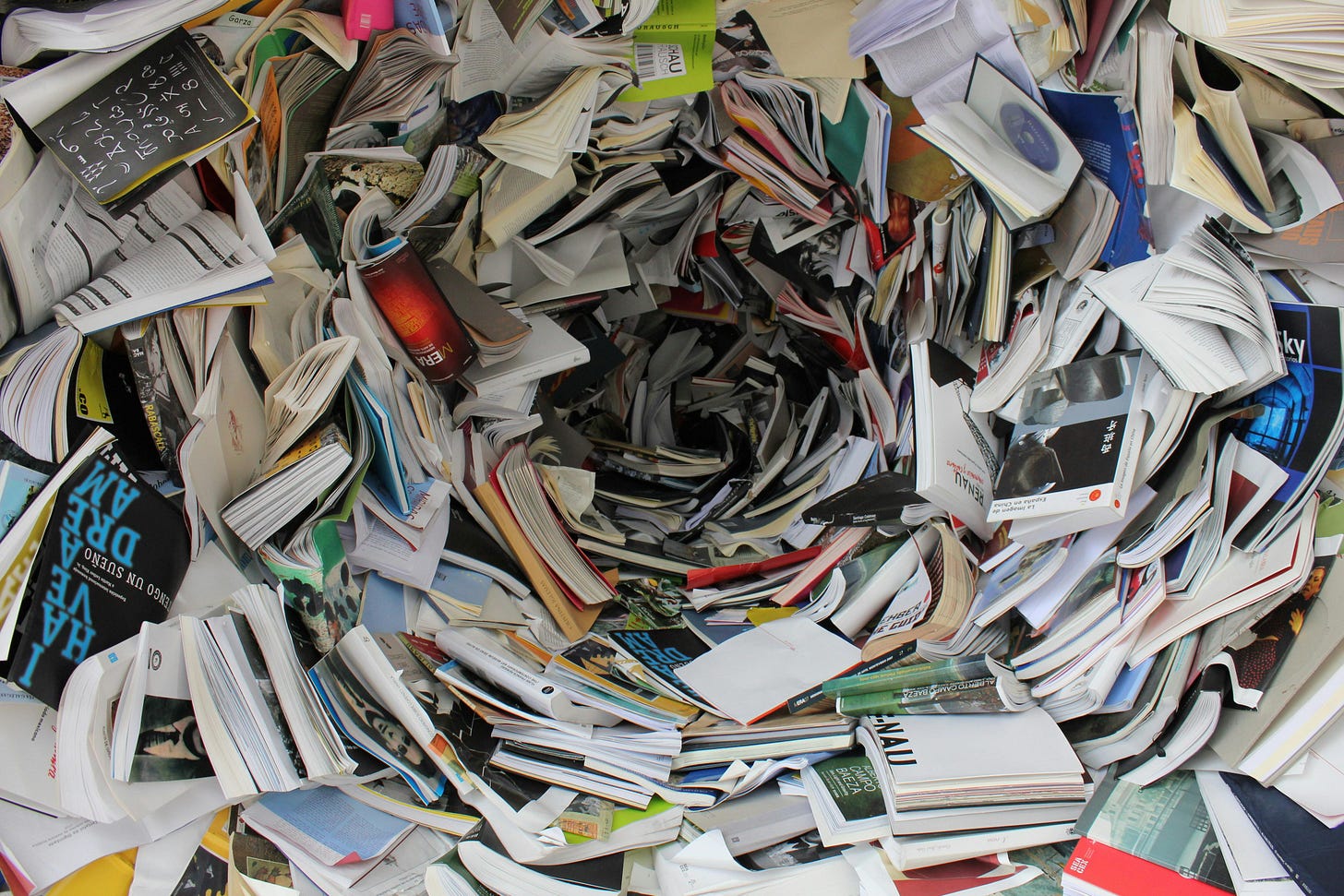

Post #18: Get organized by centralizing your paperwork, finances, and planning documents (before things get out of control).

In this Substack, I will walk you through the process of starting, operating, maintaining, and — if needed — selling or closing your own small business.

Today, I’m going to cover the importance of record-keeping and help you get your paperwork in order early (i.e.: before you are overwhelmed with customers and revenue and expenses and filing deadlines and… and… and….

💡 Tip: if you skip this step in the process, you might regret it later!

🍀 Also, this is my lucky #18 Post! 🍀

I’d love to have you as a FREE subscriber. All of my posts are FREE and I write to help aspiring business owners Bootstrap Your Business with DIY tips and money-saving guidance.

👉 Subscribe to this Substack if you want to learn how to setup, operate, maintain, scale, etc… a small business. The Journey began with Post #1.

To review:

You decided on the service or product to offer and came up with potential business names [Posts 1 & 2].

You checked a variety of sources to ensure that your potential business name has not already been claimed [Posts 3–10].

You made sure that your new business name would stand out to potential customers and not cause confusion [Post 11].

You chose the right business structure, registered your business, got a DBA for your brand name, acquired an EIN from the IRS, learned why it’s a good idea to convert your Sole Proprietorship to an LLC, and discovered the benefits of upgrading your LLC to an S-Corp [Posts 12-17].

The Importance of Record-keeping

📌 Hint: Start Early

Record-keeping is absolutely essential to running a successful small business.

This highly under-rated aspect of business ownership makes it possible for you to have a clear picture of your financial health, legal compliance, and operational efficiency.

Starting early means that you won’t have to spend any time with figuring out how to get control of the chaos when you need to find something important later.

Being organized with your paperwork will make it easier for you to:

Keep track of income, expenses, and cash flow

Find important paperwork (Articles of Incorporation, EIN, S-Corp election confirmation letter from the IRS, etc.)

Contact clients, customers, and vendors

Stay on top of important deadlines

File business taxes and other legal paperwork on time

Apply for business loans

Prepare for audits

Avoid unnecessary bank fees

Delegate work to employees and subcontractors (as your business grows)

and more!

If you get organized and maintain a record-keeping system, you can spend more time focusing on your customers and less time on administrative minutia, paper-shuffling, or hunting for lost paperwork or files.

Are you running your business or is your business running you?

General Guidelines for Record-Keeping

Let’s start with some pretty obvious reasons.

Start Early

Establish a record-keeping system before your business grows.

Even if you haven’t made a dime, yet, you already have lots of important documents and paperwork that need to be saved and protected for future reference.

Separate Personal and Business Finances

Keep track of your business expenses and income, and maintain clear separation between personal and business.

When you maintain this separation “as you go”, it will be a lot easier to manage you business finances without the clutter of personal expenses creating confusion.

💡 Tip: I will be diving into greater depth on business expenses that you can deduct from your business income in future posts. Subscribe to be notified when this topic is released!

Create a Document Organization System

Set up a digital and/or physical filing system to keep track of all sorts of documents and files.

You may need both!

A digital filing system is great for:

Screen captures from online application submissions (just in case your application is delayed or gets lost along the way).

Confirmation emails received from the IRS, Secretary of State, and licensing authorities.

Legal contracts (between your business and customers or clients) which contain evidence that the contract is real and has been executed.

Signed Bills of Sale, Purchase Orders, or Work Orders.

As a business owner, you will eventually have to send proof (by email or other online communication method) of one or more important documents as part of your recurring business operations.

A physical filing system is great for:

Keeping track of all of those pesky paper receipts that you might need in the event of an audit.

Reconciling packing slips that come with physically shipped products.

Storing all of the paper mail that comes in and needs to be referenced or updated at a later date.

Record-keeping Types for Your Business

I can’t possibly cover everything here, but let’s get you started with some basics.

Legal Records

You don’t need to hire a lawyer or pay for a fancy business registration service to set up your company, but you will need to keep track of your paperwork from this process.

You should already have a folder on your computer and/or a file cabinet with these documents:

Articles of incorporation or LLC formation documents (from registering with the Secretary of State)

S-Corp election (Form 2553, which you submitted to the IRS)

S-Corp Confirmation letter from the IRS (that your business was accepted as a new S-Corp)

Business operating agreements or bylaws

Business licenses and permits

💡 Tip: some of this legal paperwork was covered in earlier articles (Days 12–17), and some will be covered in future articles. Subscribe to be notified when more topics are released!

Financial Records

You don’t need to get a bookkeeper, an accountant, or an executive assistant (right away… or at all).

Save your money while you are not yet generating revenue and do this work yourself while you are just getting started.

Yes! Bootstrap Your Business!

You will need to keep track of:

Income (earned from customers or clients)

Expenses (receipts, invoices, and bills that you pay)

Bank statements (business checking and savings accounts)

Credit card statements

Proof of payment (checks, wire transfers, screenshots or email for digital payments)

Loan paperwork

Funding agreements (if you have investors)

Petty cash logs (if applicable)

💡 Tip: there are a ton of great applications that you can use to track income and expenses, but I will be sharing more about how to use Intuit QuickBooks in future posts.

This application is an industry-wide standard that has a comprehensive suite of features, offers a great deal of flexibility, and will scale as your business grows.

Subscribe to be notified when more on this topic is released!

Customer, Vendor, and Partner Documents

Depending upon the types of products and/or services you are offering, you will need to keep track of interactions, transactions, and agreements between your customers, clients, and vendors.

For example:

Service Agreements

Purchase Orders

Proof of delivery receipts

Service completion receipts

Non-Disclosure Agreements (NDAs)

Non-Compete Agreements (NCAs)

Master Service Agreements

Work Orders / Statements of Work

These types of events can be tracked in your QuickBooks accounting, paper filing system, digital records, and digital calendar of events (or Business Journal).

Operational Records

Track your day-to-day operational activities if you want to keep your business running more smoothly, simplify delegation to employees and contractors, and stay on top of maintenance (for services or equipment).

Inventory logs (to track your inventory of products)

Maintenance and service records for business equipment (printers, scanners, or other equipment that is unique to your business)

Insurance policies and claims records

Software subscriptions and software vendor agreements

Agreements with other service providers (security monitoring service, cleaning service, IT support service)

In some cases, a simple calendar with notifications, reminders, and recurring events will do the trick.

Or, you may want to keep a living document (like a Google Sheet or Doc file) to track specific records if you know that you will need to make amendments or add details.

Tax Records

Oh boy, don’t mess around with these types of records.

The IRS is like Santa Claus (he just knows!), so be sure to stay on top of this paperwork, avoid missing deadlines, and keep track of events to save yourself a lot of headache and penalties.

In fact, you may want to keep these records in more than one location as a backup plan:

Copies of filed tax returns.

Quarterly estimated tax payments.

1099s (issued and received).

Payroll tax records (if you have employees).

💡 Tip: as you process, file, or receive these types of documents, save them to a good place on your computer for easy access, make a copy in a secure digital location, and then print them for paper filing just in case your digital versions are lost due to security breaches (hacks) or computer failures.

Employee and Contractor Records

As your business grows, you may want to get help by hiring employees, contractors, and/or subcontractors.

Expanding your team comes with a bit of paperwork and some red tape, which you will also need to keep track of:

Employment agreements, W-4s, I-9s, and payroll records

Independent contractor agreements and W-9 forms

Bonus and Performance agreements

NDAs and NCAs (for staff)

Most of these file types are long documents or short PDF files which are best kept in a digital document filing system (and printed!).

Business Planning and Strategy Documents

Too many businesses owners get going on a whim, with no plan or strategy.

While this may sound exciting and lucky, it is a sure-fire path to an early demise (or at least another layer of “chaos”, as I mentioned earlier).

As you work on your business plan and strategy, you should keep records of:

related documents

brainstorming diagrams

research notes

marketing analysis and data

tips and guidance from mentors and colleagues

and more!

Whether you use a cloud tool for brainstorming, white board for ideation, or paper notebook to track ideas while you are running errands, all of these data should be captured safely someplace.

Basically, if it feels like information that could be useful - in any capacity - in the future, you may want to just add it to your record-keeping system.

“…what gets measured gets managed” — Peter Drucker

💡 Tip: Subscribe to be notified when I share more ideas for business planning and strategy!

Next Steps

Even if you don’t have much to add to your new record-keeping system, this should help you wrap your brain around what you may need as your business grows.

Staying current with administrative “paper-shuffling” and you will thank yourself later.

In the next post, I’m going to cover the basics of business bookkeeping so that you can keep track of your business expenses (and keep your personal expenses separate).

Continue the Journey with Post #19 —>

You should turn this series into a checklist and then link to these posts if they need more info. Then you could either sell it as a plan or offer it as a freebie then have a bigger offer like a planner, mini course, etc. that they could buy for more help.