Deducting Home Repair and Maintenance Expenses from Your Business Income Taxes

Post #30: Did you know that home repairs and maintenance may be eligible for the home office deduction on your self-employed income taxes?

In this Substack, I will walk you through the process of starting, operating, maintaining, and — if needed — selling or closing your own small business.

Today, I’m going to share some tips and recommendations for ways that you - a self-employed freelancer or business owner - can save money on your tax bill by deducting home office expenses related to home repairs and maintenance.

I will also help to differentiate direct from indirect expenses so that you can further maximize your home office deductions.

Yes! If you have an expensive roof repair, need to replace your security alarm system, or the carpet had to go (!!!), you may be able to deduct a portion of these expenses (and others) from your income taxes.

👉 Subscribe to this Substack if you want to learn how to setup, operate, maintain, scale, etc… a small business. The Journey began with Post #1.

Also, be sure to check out these FREE resources:

Bootstrap Your Business Workflow - a step-by-step guide with the links to all of the top daily posts that walk you through the process from scratch

BYB Book Recommendations - a collection of the best business books to help you on your entrepreneurial journey

BYB News Alerts! - urgent news and updates for self-employed and business owners - delivered to your inbox - so that you can be more prepared

About Home Office Deductions

A quick refresher…

As a small business owner operating from home, understanding the nuances of tax deductions can significantly impact your bottom line.

To find out whether you are eligible to deduct home office expenses, check out my last post on this topic:

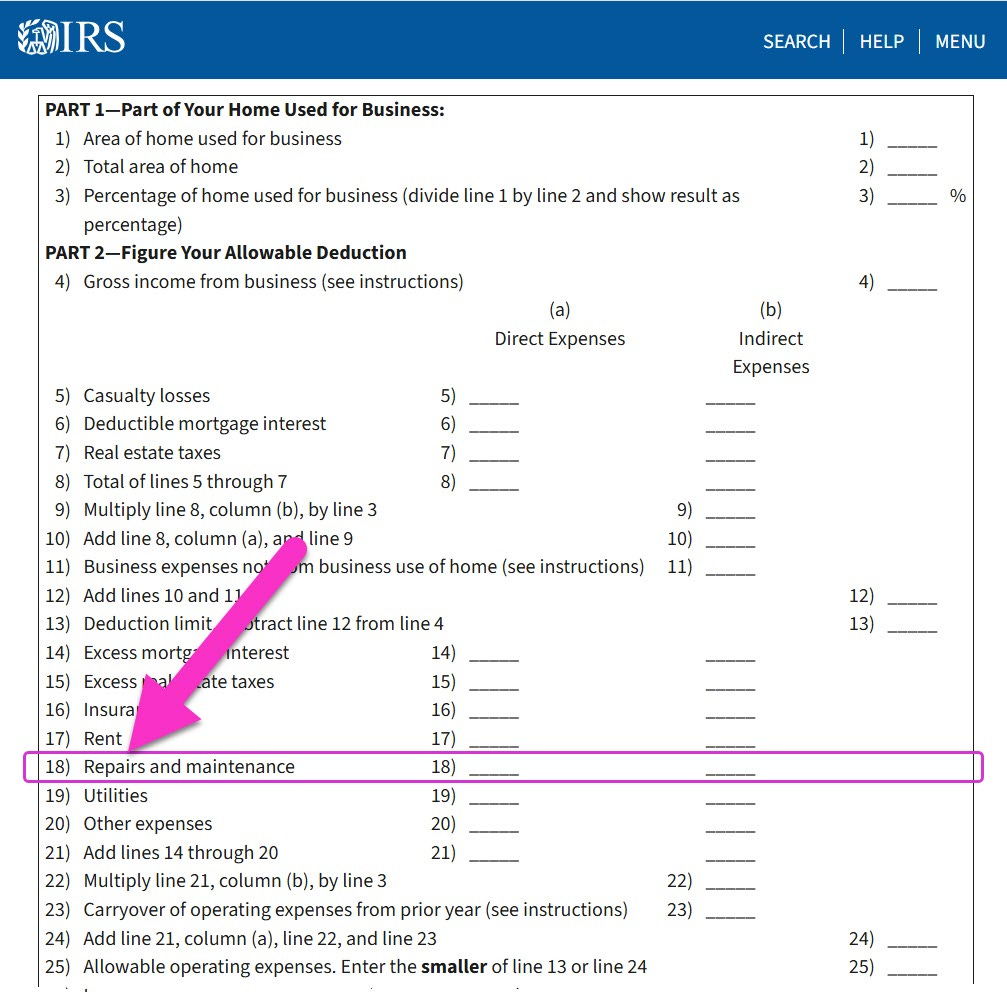

IRS Worksheet for Schedule F

The IRS website has a boatload of useful resources to help you.

Be sure to check out the “Worksheet To Figure the Deduction for Business Use of Your Home” (click here: IRS Worksheet for Schedule F).

On this worksheet, home repairs and maintenance are merged under “repairs and maintenance”.

💡 Tip: Don’t be afraid of the IRS! If you are following the rules and doing the right thing, you can deduct these expenses as part of your business operations. Read more…

Eligibility of Home Repairs and Maintenance for the Home Office Deduction

The IRS permits taxpayers who use a part of their home exclusively and regularly as their principal place of business to deduct associated expenses.

💡 Tip: Learn more about your eligibility for the home office deduction.

This includes costs related to repairs and maintenance of your residence.

Such expenses are categorized as either direct or indirect:

Direct Expenses

Costs incurred specifically for the home office space.

Direct expenses are fully deductible because they are directly related to running your home-based business.

For example, if you hire a painter to paint your home office, that expense is fully deductible from your business income.

Indirect Expenses

Costs for repairs and maintenance that benefit the entire home.

Indirect expenses are deductible based on the percentage of your home devoted to business use because the repair was done for the whole house, not just your home-based office.

For example, if you replace your roof, upgrade your HVAC system, or hire a technician to repair the AC unit, these expenses can be deducted partially.

Calculating Deductions for Repairs and Maintenance

There are two calculations, depending upon whether the expenses are direct or indirect, as defined above.

You may need to do both calculations if you have some repairs and/or maintenance that are direct and others that are indirect.

Calculating Direct Expenses

For direct expenses, since they pertain solely to the home office, you can deduct these costs in full.

Calculating Indirect Expenses

To determine the deductible amount for indirect expenses, calculate the total cost of the repair bill multiplied by the percentage of your home's square footage that is used for your home office.

For example:

Your home office occupies 150 square feet

You live in a 1,500-square-foot home

The business use percentage is 10%.

The repair bill is $10,000

You can deduct $1,000 (10% of $10,000) as a business expense for this particular indirect home repair expense.

Non-Deductible Costs

Not all home-related expenses are deductible.

Costs unrelated to the maintenance or repair of your home office, such as improvements that increase the property's value (e.g., adding a new room or renovating the kitchen), are considered capital expenses and are not deductible as current expenses.

However, they may be depreciated over time.

💡 Tip: for more information about depreciation of your home as part of the home office deduction, subscribe to this substack! This post is coming soon!

What if you Have Roommates?

If you share your living space with roommates and pay rent, you can still claim the home office deduction, provided you meet the exclusive and regular use criteria for your business area.

💡 Tip: if you are sharing your home with roommates, your total square footage calculation may be different. Read more…

Ensure you have a clear agreement on shared expenses and maintain detailed records to substantiate your claims.

Next Steps

In the next post, I am going to introduce the concept of Depreciation, in the context of home office expenses and income tax deductions for your home-based business.

This can be a very confusing topic, but I am going to break it down so that it’s easy to understand and apply for your tax deductions.

Continue the Journey with Post #31 —>

Cool! I was telling a friend earlier this week that EVERYONE should have a business to take advantage of write offs that we complain that rich people get. It also makes sense to sell your labor as an independent contractor with his/her own fiefdom.

This is so helpful!!