Cut Your Taxes: Internet and Phone Bills Qualify for Home Office Deductions

Post #28: Small business owners who work from home can deduct a portion of internet and cell phone bills from small business gross revenues.

In this Substack, I will walk you through the process of starting, operating, maintaining, and — if needed — selling or closing your own small business.

Today, I am going to share the ins and outs of how to reduce your annual tax bill by deducting a portion of the cost of your internet and phone bills (landline and mobile) from your business’s gross revenues.

While this may not sound like a big opportunity to save money on your tax bill, it adds up when you include other home office expenses that are deductible as part of the cost of doing business from your home.

You can actually overpay your taxes if you are not deducting all of the expenses that you are eligible to deduct!

👉 Subscribe to this Substack if you want to learn how to setup, operate, maintain, scale, etc… a small business. The Journey began with Post #1.

Also, be sure to check out these FREE resources:

Bootstrap Your Business Workflow - a step-by-step guide with the links to all of the top daily posts that walk you through the process from scratch

BYB Book Recommendations - a collection of the best business books to help you on your entrepreneurial journey, with direct links to Amazon.com

About Home Office Deductions

A quick refresher…

As a small business owner operating from home, understanding the nuances of tax deductions can significantly impact your bottom line.

To find out whether you are eligible to deduct home office expenses, check out my last post on this topic:

IRS Worksheet for Schedule F

The IRS website has a boatload of useful resources to help you.

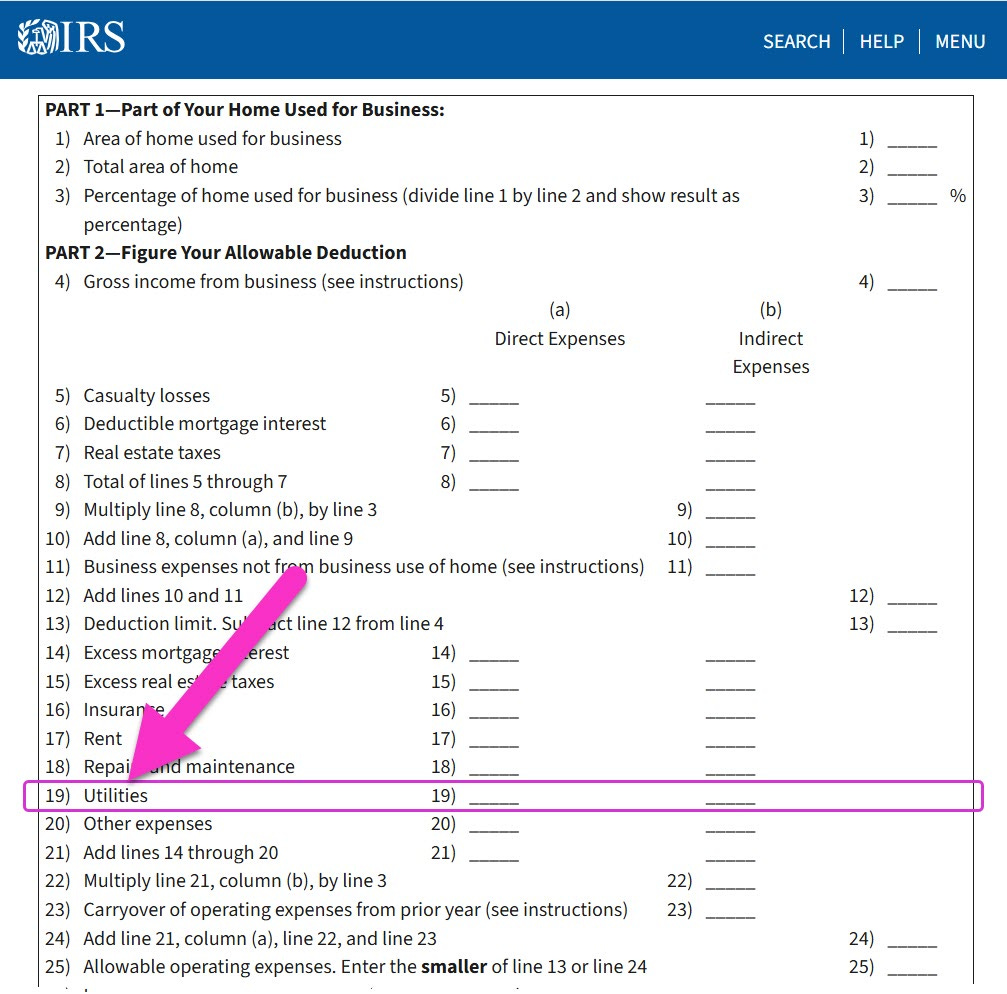

Be sure to check out the “Worksheet To Figure the Deduction for Business Use of Your Home” (click here: IRS Worksheet for Schedule F).

On this worksheet, Internet and Phone Bills are considered “Utilities” and can be added to your other utility bills as a single dollar amount when you do your taxes.

💡 Tip: Don’t be afraid of the IRS! If you are following the rules and doing the right thing, you can deduct these expenses as part of your business operations. Read more…

Meaning of “Ordinary and Necessary”

According to the IRS, an ordinary expense is one that is common and accepted in your industry, while a necessary expense is one that is helpful and appropriate for your trade or business.

Note that an expense doesn't have to be indispensable to be considered necessary.

Specifically,

To be deductible, a business expense must be both ordinary and necessary. An ordinary expense is one that is common and accepted in your industry. A necessary expense is one that is helpful and appropriate for your trade or business. An expense does not have to be indispensable to be considered necessary. (source)

One area ripe for potential savings is the deduction of internet and phone expenses associated with your home office.

Your Internet Bill May Be Deductible

The U.S. Internal Revenue Service (IRS) allows taxpayers to deduct expenses that are both ordinary and necessary for their trade or business.

If you use your home internet connection for business-related tasks—such as communicating with clients, managing business finances, or conducting research—the portion of your internet usage attributable to these activities is deductible.

Keep in mind that only the business-use percentage of your internet expenses qualifies for deduction. You can’t deduct the personal use portion of your internet bill.

Your Phone Bill May Be Deductible

Similar to internet expenses, phone expenses directly related to your business are deductible.

Home office deductions are different for these phone services:

Landline Phones

If you have a landline phone in your home, the IRS does not allow you to deduct the cost of the first line, even if it's used for business purposes (except when making long distance business calls).

However, if you install a second landline specifically and exclusively for business use, the full cost of this line is deductible.

Specifically, from the IRS website:

“The basic local telephone service charge, including taxes, for the first telephone landline into your home is a nondeductible personal expense. However, charges for business long-distance phone calls on that line, as well as the cost of a second line into your home used exclusively for business, are deductible business expenses. Do not include these expenses as a cost of using your home for business. Deduct these charges separately on the appropriate form or schedule.”

In this case, the IRS is referring to Schedule F (see above).

Mobile Phones (Cellular)

If you have a mobile phone used exclusively for business purposes, you can deduct 100% of this phone bill.

However, when you use a mobile phone for both personal and business purposes, you can deduct only the portion of the expenses that pertains to business use.

I will cover the calculation of this deduction in the next section, below.

How to Calculate Your Internet and Phone Bills Deductions

To accurately deduct internet and phone expenses, choose from two methods to do your calculations.

💡 Tip: You can review the details of these two methods, which I covered in a previous article. Read more…

Actual Expense Method (a.k.a.: Regular Method)

Much like calculating the percentage your workspace occupies within your residence, as a portion of the total square footage, you can calculate the percentage of business use that you use your internet and phone.

Internet:

Estimate the percentage of time your internet is used for business purposes.

For example, if you use the internet for business activities 40% of the time and for personal activities 60% of the time, you can deduct 40% of your internet bill.

Phone:

Review your call logs to calculate the proportion of business-related calls.

For example, if 50% of your calls are for business, you can deduct 50% of your phone expenses.

Simplified Method (if applicable)

If you're claiming the simplified home office deduction, you can deduct $5 per square foot of your home office, up to a maximum of 300 square feet.

💡 Tip: I covered this method for use in calculating your home office deductions for your residential space in a previous post, as well. Read more…

This method simplifies the deduction process but does not separately account for specific expenses like internet and phone bills.

If you find that your internet and phone bills are large, you may want to reconsider using this method and switch to the Actual Expense Method to maximize your deductions.

When Internet and Phone Bills Are NOT Deductible

There are specific scenarios where internet and phone expenses are not deductible.

I covered this a little bit earlier in this post, but I’ll summarize here for easy reference:

Personal Use

Expenses related to personal use of internet and phone services are not deductible.

Only the portion used for business purposes qualifies.

Primary Landline (Phone)

The cost of the first telephone line into your residence is considered a personal expense and is not deductible, even if it's used for business.

Insufficient Documentation

Without adequate records demonstrating the business use of your internet and phone services, the IRS may disallow the deduction.

Maintaining detailed logs and receipts is crucial.

💡 Tip: check out my earlier post on Record-Keeping for helpful hints. And

Subscribe to get notifications when new content is published!

Got Roommates?

If you share a rented residence with roommates, claiming internet and phone (landline) deductions requires careful consideration.

Exclusive Use: To qualify for the home office deduction, a portion of your home must be used exclusively and regularly for business purposes. This means your workspace should not serve any personal or communal functions.

Calculating Expenses: Determine your individual responsibility for shared expenses. For instance, if you equally split the rent and utility bills among four roommates, your share would be 25% of the total. Apply your business-use percentage to your portion of these expenses to calculate the deductible amount.

💡 Tip: I dive into more details on the methods of calculating your home office expenses when you have roommates —> Here!

Next Steps

In the next post, I am going to dive deeper into how you can calculate your home office deduction for Homeowners or Renters Insurance.

Continue the Journey with Post #29 —>