Claiming Business Furniture and Equipment as Home Office Expenses

Post #32: When you are self-employed, don't forget to deduct the cost of furniture and equipment that you use in your home-based business.

In this Substack, I will walk you through the process of starting, operating, maintaining, and — if needed — selling or closing your own small business.

Today, I am going to cover methods for deducting the cost of furniture and equipment used for working in your home-based business when you are filing your tax return.

You definitely CAN reduce your tax bill by subtracting the cost of these common items from your business’s gross revenues:

your desk (even if you got it from a garage sale for $10)

your office chair (the one that was on sale for 50% off because the wheel was sticky)

your computer (new or refurbished from eBay - both are eligible!)

your printer (sure, the toner cartridge is running out of ink - doesn’t matter)

your file cabinet (yeah, from craigslist… and your kid scribbled all over the sides)

BUT, WAIT!!

You can also deduct:

your brand new, expensive, hand-crafted, solid maple (with dovetail drawers, of course!) Scandinavian desk that you inherited from your great-grandfather!

your matching desk, file cabinet, and chair set from IKEA… you know, the set that you fell in love with when you first saw it in their “show room” next to the bean-bag and lava lamp chillaxin’ demo space.

your ergonomic, powder-pink, adjustable hello kitty gaming chair (affiliate link is here - just for fun - yes, this exists!).

These are just a few of the examples of the eligible items that you can deduct as home office expenses.

Bottom Line: If you use this equipment for business, it probably qualifies!

👉 Subscribe to this Substack if you want to learn how to setup, operate, maintain, scale, etc… a small business. The Journey began with Post #1.

Also, be sure to check out these FREE resources:

Bootstrap Your Business Workflow - a step-by-step guide with the links to all of the top daily posts that walk you through the process from scratch

BYB Book Recommendations - a collection of the best business books to help you on your entrepreneurial journey

BYB News Alerts! - urgent news and updates for self-employed and business owners - delivered to your inbox - so that you can be more prepared

About Home Office Deductions

A quick refresher…

As a small business owner operating from home, understanding the nuances of tax deductions can significantly impact your bottom line.

To find out whether you are eligible to deduct home office expenses, check out my last post on this topic:

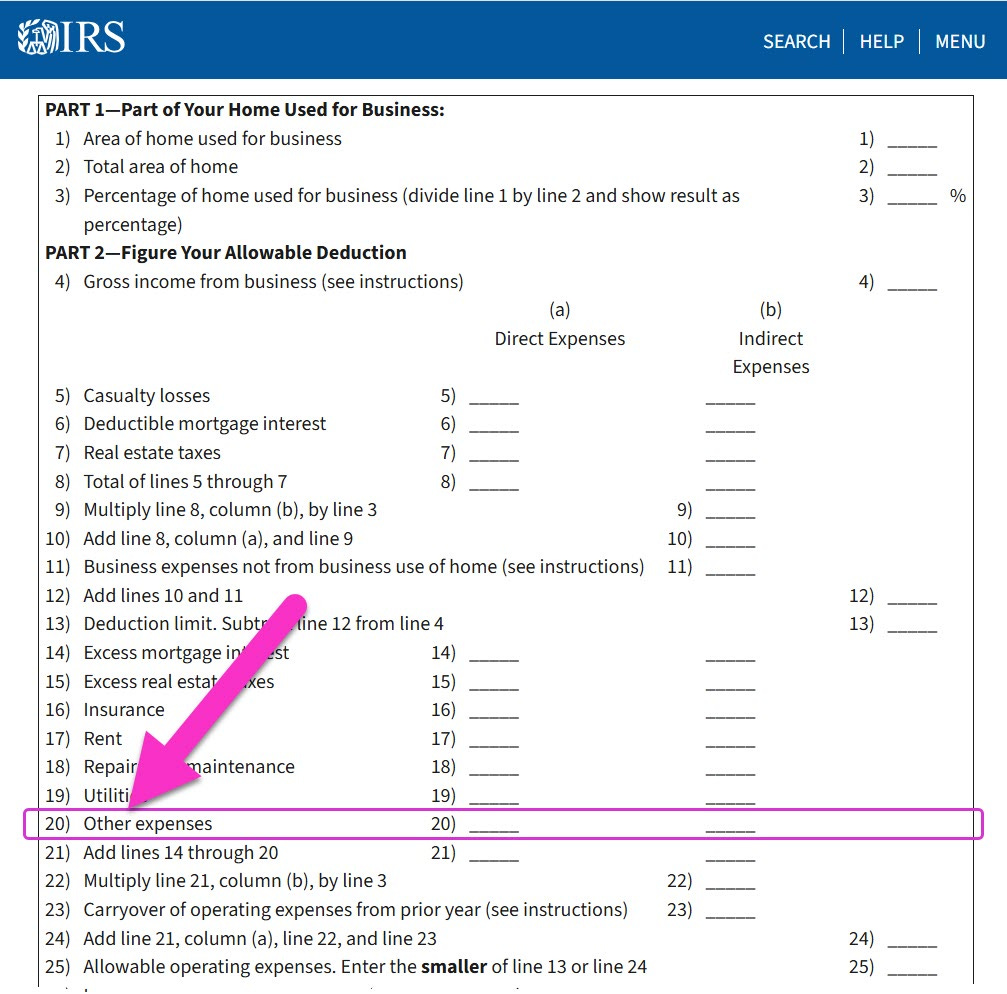

IRS Worksheet for Schedule F

The IRS website has a boatload of useful resources to help you.

Be sure to check out the “Worksheet To Figure the Deduction for Business Use of Your Home” (click here: IRS Worksheet for Schedule F).

On this worksheet, Business Furniture and Equipment in your home that is used for business can typically be entered under “Other Expenses”.

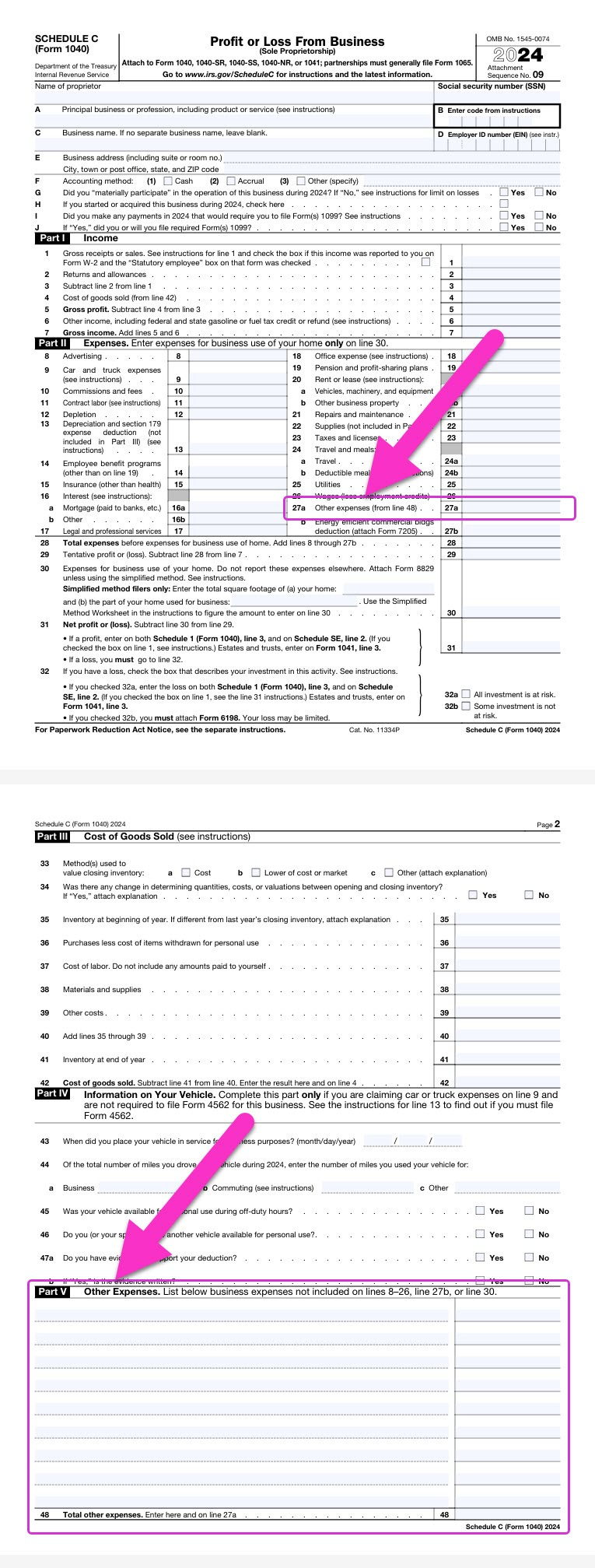

IRS Schedule C (for Sole Proprietors)

For Sole Proprietors, you may want to take a look at IRS Schedule C (Form 1040), Profit or Loss from Business to determine whether this form is more in alignment with your particular income tax reporting needs (click here: IRS Schedule C).

On this worksheet, Business Furniture and Equipment in your home that is used for business can typically be entered under “Other Expenses”. There is a whole table in this IRS form where you can itemize these expenses, as needed.

📌 Don’t be afraid of the IRS!

If you are following the rules and doing the right thing, you can deduct these expenses as part of your business operations. Read more…

Why Business Furniture and Equipment Are Deductible

The Internal Revenue Service (IRS) allows deductions for ordinary and necessary expenses incurred in the course of running a business.

This includes furniture and equipment essential to your home office operations.

By deducting these expenses, you can reduce your taxable income, thereby lowering your overall tax liability.

Documenting Expenses for Furniture and Equipment

Good record-keeping is important for this type of home office expense.

Save (or Create) a Proof of Purchase

Keep receipts, invoices, and proof of payment for each item that you purchased for your business from a third party vendor (such as a store).

Create your own receipt to document a purchase, if you bought an item from a garage sale or via an online source with a physical pickup location and no formal vendor’s receipt. In this case, you can screen capture the online post (if it exists) or find another way to create a document that can be saved in your business’s record-keeping system.

Create a Bill of Sale if you need to convert furniture or equipment from personal ownership to business ownership (yes - your business can buy furniture and equipment directly from you with a proper Bill of Sale document and proof of payment).

💡 Tip: Get this editable BYB: Bill of Sale (template) from my Gumroad store.

Demonstrate Exclusive and Regular Usage

If you want to deduct 100% of the item on your taxes, keep these tips in mind:

Business furniture or equipment that will be 100% deducted should be (when possible) physically located within your home workspace to keep things simple and to demonstrate that it is used exclusively and regularly for business purposes in your home.

When deducting 100% of a computer (for example), this equipment should not be available for use by roommates, family members (including your kids), or friends.

Choose a Deduction Method

There are a few nuances to deducting business furniture and equipment.

Direct Expense Deduction (All in One Year)

Most business furniture or equipment can be deducted easily as an “Other Expense” on your Schedule C or Worksheet F (as I mentioned above).

Alternatively, if you want to deduct an expensive item in a single tax year, you can use Section 179 to do so.

💡 Tip: Read more about Section 179 directly within the IRS website here and here.

Depreciation (Across Multiple Years)

You may need to depreciate the cost of these expenses over more than one year.

Specifically, this will help your financial planning if:

your business income was lower than your business expenses (you can’t deduct more than you made)

the item was expensive and you want to distribute the cost across a longer period to reduce your tax liability over more than one year

Partial Deductions

Most equipment that is not used exclusively for business purposes, or items considered personal expenses, are not eligible for the home office deduction.

However, if the equipment is used partially for business, you may be able to deduct the business-use portion as a regular business expense, separate from the home office deduction.

For instance, if a computer is used 70% for business and 30% for personal use, you can deduct 70% of its cost as a business expense.

By carefully tracking your expenses and understanding IRS guidelines, you can:

effectively deduct the partial cost of business furniture and equipment,

optimize your tax savings, and

remain in compliance with the law.

Next Steps

In the next post, I will cover the last big item in the list of home office deductions: Property Taxes for your home.

Every residential property owner sends a large chunk of money to state and local government revenue departments in the form of property taxes.

Don’t leave this significant home office deduction behind!

Continue the Journey with Post #33 —>