📝 Bill of Sale: 7 Reasons to Create Your Own Receipt (Buying or Selling)

Post #37: If you need a proof of purchase (or sale) for a business-related expense, you can make your own receipt.

In this Substack, I will walk you through the process of starting, operating, maintaining, and — if needed — selling or closing your own small business.

Today, I am going to cover the purpose of a Bill of Sale (with a guide to create and use one) to capture a proof of purchase when you don’t - or can’t - get a receipt.

In this post, I will show you:

What is a Bill of Sale

Reasons to use a Bill of Sale

What is typically contained in a Bill of Sale template

A link to download a customizable Bill of Sale template

This super-simple document can help solidify your record-keeping system, reduce your tax liability, and protect you from liability after you sell a potentially risky asset.

👉 Subscribe to this Substack if you want to learn how to setup, operate, maintain, scale, etc… a small business. The Journey began with Post #1.

Also, be sure to check out these resources:

Bootstrap Your Business Workflow - a step-by-step guide with the links to all of the top daily posts that walk you through the process from scratch

BYB Book Recommendations - a collection of the best business books to help you on your entrepreneurial journey

BYB News Alerts! - urgent news and updates for self-employed and business owners - delivered to your inbox - so that you can be more prepared

BYB Documents - a repository of guidance for important business documents with instructions and guides to use them in your self-employment journey (link coming soon!)

What is a Bill of Sale?

As a freelancer or small business owner, keeping a meticulous paper trail is essential - especially when it comes to tracking business-related purchases.

While most vendors or sellers provide a receipt following the transactions, there are many instances where this may not be feasible.

That’s where a Bill of Sale comes in handy - it can be used for:

a Proof of Purchase when you are the Buyer, or

a Proof of Sale when you are the Seller.

7 Reasons to Use a Bill of Sale

There are many reasons why you should be using a Bill of Sale for your business’s record-keeping system and financial management.

📌 A Bill of Sale is like a two-sided coin…

…you can use the same document regardless of whether you are the Buyer or the Seller.

When You Are the Buyer

As a Buyer, you may need a Bill of Sale when:

(1) You Lost the Receipt

Even the most organized business owners misplace receipts.

If you purchased an item for your business but can’t find the original receipt, a Bill of Sale acts as a backup.

It provides documentation of the transaction, ensuring you have a record when tax time rolls around.

(2) You Never Got a Receipt

If you buy business-related equipment from a garage sale, a local marketplace listing, or a person selling publicly, you may not receive a formal receipt.

A Bill of Sale helps bridge this gap by serving as official proof of the purchase, listing details like the item, price, date, and seller’s information.

(3) You Are Converting Personal Assets to Business-Owned Assets

If you start your business with personal assets (i.e.: such as a printer, desk, or laptop), you can sell these assets to your business and deduct them as a business expense.

A Bill of Sale documents this transaction, ensuring proper accounting and tax deductions.

(4) You Are Purchasing Used Items

Many freelancers buy used office furniture or equipment at discounted prices from other businesses or individuals (e.g.: via facebook marketplace or craigslist).

Unlike retail purchases, these transactions often lack a formal receipt from the seller.

A Bill of Sale can serve as a simple record of ownership transfer and payment, which may also be useful for depreciation and tax deductions.

When You Are the Seller

As a Seller, you may need a Bill of Sale when:

(5) You Need Proof of Ownership for Resale or Insurance

If your business sells a used asset - such as a laptop or camera - a Bill of Sale can document that you were the legal owner before transferring it to a buyer.

Additionally, some insurance companies require proof of purchase for claims, making this document valuable in case of loss, theft, or damage.

💡 Tip: Don’t use a Bill of Sale when buying or selling a vehicle. There are other documents available from your local DMV for this kind of transaction.

(6) You Are Converting Business-Owned Assets to Personal Assets

If your business purchased an asset and it’s no longer needed, you want to gift the asset to a friend or family member, or you want to donate the item to a local charity, your business can sell the item to you first.

In this case, your business will be able to remove that item (after the sale) from the “books” ( i.e.: your business’s assets and inventory) and you - as an individual - can do whatever you’d like from there with that item.

(7) You Need to Prove You No Longer Own an Asset

Some assets may be associated with liability or risk, and many business owners will opt to purchase special insurance to protect their business from that liability or risk.

When it comes time to get rid of that asset - along with the liability or risk that comes with it - the insurance coverage is no longer needed, either.

A clear paper trail of the sale of that asset is essential to protecting the business (and yourself as the owner) from future claims or lawsuits.

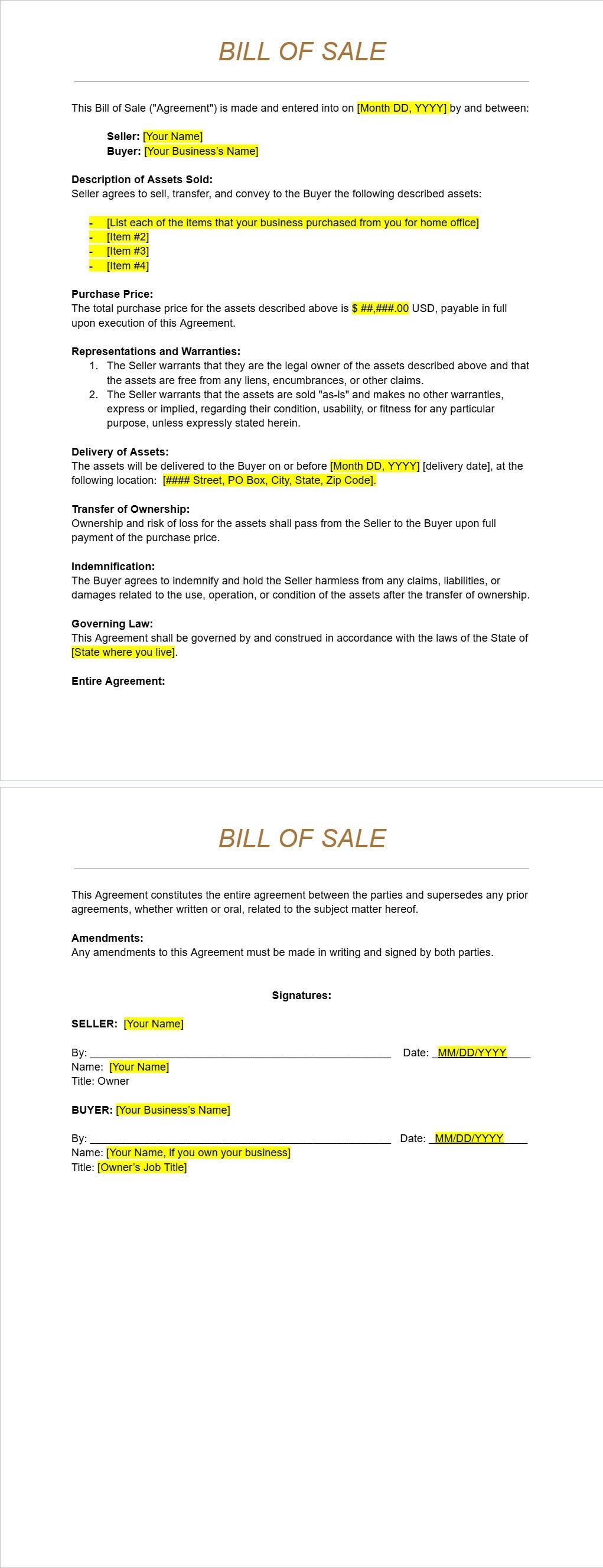

What a Bill of Sale Looks Like

This simple 2-page template is easy to edit to include the details you need.

Here is what it looks like.

Get the Template

If you want to save your precious time, you can buy the template here:

What You Need to Complete this File

The following data fields are needed to complete this simple template:

Effective Date of the Transaction

Seller Name (this could be a business or individual)

Buyer Name (this could be a business or individual)

Description of the item(s) being sold (this could be a list of multiple items)

Total monetary value of the Bill of Sale (summary of price of all items)

Date that the item(s) will be physically transferred to the Buyer (this is the “delivery date”)

Address to which the item(s) will be physically transferred to the Buyer

The state in which the transaction occurred (for governing law in the event of a dispute)

Signatures with Buyer and Seller representatives (in the case of a business being the buyer and/or seller)

Date Signed

Due Diligence

Do your due diligence when you are creating any Bill of Sale documents as part of your record-keeping system.

I am an entrepreneur - not a tax professional or a CPA - so please keep in mind that your unique circumstances may be different from what I have captured here.

When uncertain or confused, it is best to consult an accountant or tax advisor to help you.

Next Steps

In the next post, I am going to cover Expense Reporting and Reimbursements!

This is one of my favorite topics - and highly underrated - because it’s a major component to why smart business owners set up an LLC or S-Corp (to save money!).

Continue the Journey…

I’m learning so much from you! I never knew this! I’m going to bookmark this. I usually have digital receipts but I might need your idea. 💡

Looks like this newsletter breaks down how to make your own Bill of Sale, especially when you don’t have a receipt. It goes over what it is, why you’d use it, and even gives a guide with a customizable template to make it easy.